|

As we approach November and the Presidential election nears, it would be good to look back on how election years have historically affected the real estate market. There is certainly a lot going on and this stimulation can cause pause. Buying and selling real estate is a big life event and the election is a big national event. Some buyers and sellers will delay their moves until after they know how the election is going to pan out. Sometimes this delay is caused by pure distraction and sometimes there is a level of uncertainty that is created until a decision is made.

Here is some interesting data that illustrates the trends of consumer behavior surrounding a Presidential election. Interest rates, the rate of home sales, and price growth are all analyzed below. Looking back to look forward provides some concrete evidence of how a Presidential election can affect the performance of the housing market.

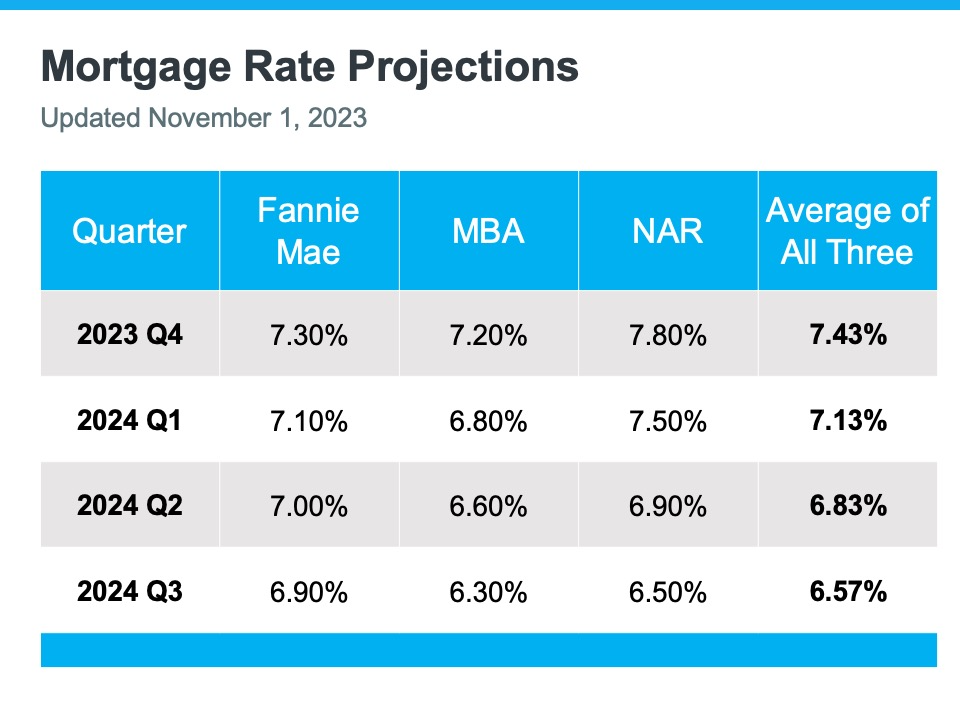

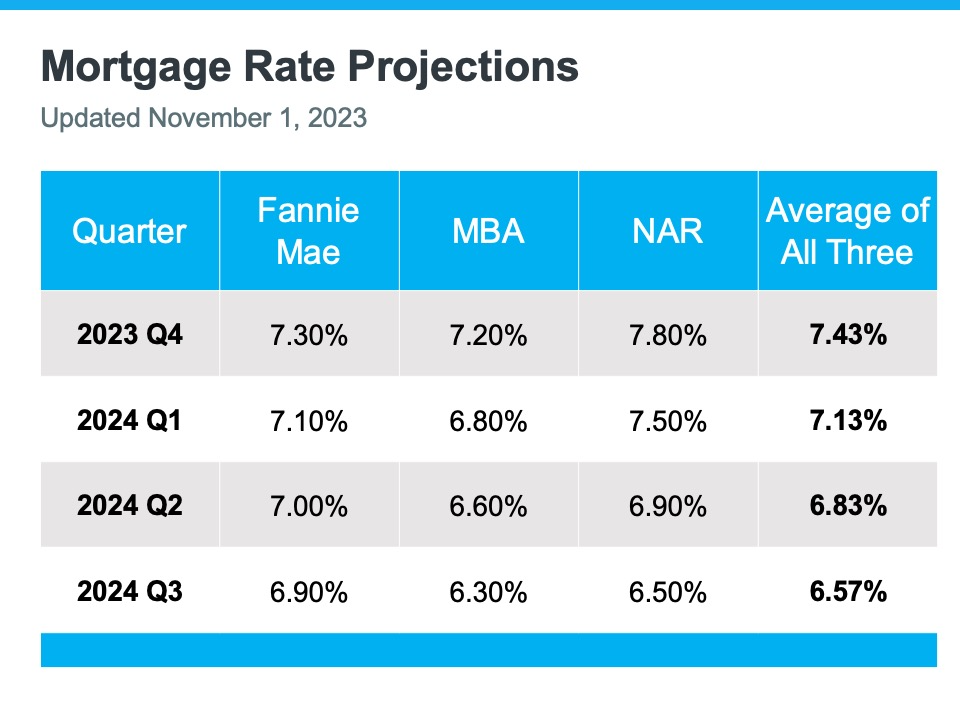

First, interest rates! We have recently experienced a nice drop in rates. Rates have been extremely volatile over the last two years. Last October, rates peaked at almost 8%, came down to 6.75% in January 2024, went back up to 7.4% in April 2024, and have recently dropped to the lowest level we have seen since April 2023 and are hovering around 6.5%. This is largely due to inflation finally settling and a recent jobs report showing increased unemployment. This trend is predicted to continue as the Fed considers a rate cut in September with the plan of easing rates as we finish 2024 and head into 2025.

The chart below shows what rates have done over the last eleven election cycles and it certainly looks like the current trend with rates follows historical norms. This is an opportunity for buyers to jump into the market as this reduction in rate is accompanied by an increase in inventory. With lending costs lower and more selection buyers could even find themselves in a position to negotiate a further reduction in rate to help with the overall affordability of a purchase.

The market is very much driven by what a buyer's monthly payment would be. Lending costs are a huge factor that will play into consumer confidence and the amount of sales happening. Further, we expect more home sellers to come to market as rates ease as they will be more inclined to give up their low rate to move to a home that is a better fit for their lifestyle.

The chart below shows the increase in home sales in nine out of the eleven past election cycles. In fact, the first year after an election is historically robust with activity. If history repeats itself in 2025, buyers who are ready may want to consider making a move now. With the dip in rate, increased selection, and some buyers sidelined it could be a great time to make a purchase with a little less competition.

Even better news is that historically prices increase after an election year. In seven out of the last eight post-election years, prices increased. The only year they did not, was 2008 which was in the hollows of the Great Recession. Of course, we will not be able to measure this until a year from now and this will be something that I will be paying close attention to.

So far, 2024 has been a year of price growth. We experienced huge gains in the first half of the year over 2023. 2024 marks the year of recovering from the 2022 post-pandemic correction and re-gaining price stability. Equity levels in our area are very strong with close to 60% of homeowners having at least 50% home equity. We expect the movement of this equity to become more nimble as the cost of borrowing money comes down.

What we have in store over the next three months will be distracting, stimulating, and just a lot. I hope the information above provides some history that helps ground the facts during a time of heightened angst and uncertainty. As always, life dictates changes in real estate needs. If you or someone you know has come up on some life changes that indicate a move would be beneficial, please reach out.

Despite the chaos of the election, you can never plan too early for these big life transitions and there might be some great opportunities amongst the noise. Whether it's a purchase, a sale, or both, I am equipped to help you assess your goals and help you devise a plan. The best time to make a move is when you're ready and I'm here to help.

|

|

As we approach the mid-point of the year, I want to take a moment to explain all that has happened in the 2024 real estate market and where we might be headed. We have had strong price growth since December 2023, and in May 2024 prices matched the peak we saw in spring 2022. The interest rate increase and inflation-induced correction that took place in the spring of 2022 has shown very strong signs of recovery and stabilization. The chart below shows the last 17 months of median prices in both King and Snohomish Counties and also tracks the ebb and flow of interest rates.

Despite interest rates fluctuating between 6.75-7.5% from January through May 2024, price growth has been on an upward trajectory. Most recently, rates have hovered close to 7%. Inventory started the year very low! In King County, there were only 1,324 new listings in January and 534 in Snohomish County. This trend continued throughout Q1 2024 and has started to increase in Q2. In May 2024 there were 3,245 new listings in King County and 1,272 in Snohomish County. That was a 145% increase in King County from January to May and 138% in Snohomish County. Markedly, there was a 27% jump in new listings from April 2024 to May 2024 in King County and 34% in Snohomish County.

Adequate selection for buyers was limited, which drove prices up over the past five months. Buyers are starting to see some relief! There is healthy net in-migration into the Greater Seattle area, a stable job market, and the Millennial generation is out in force making their first purchases and some even moving up from their first homes. Since December 2023, the median price in King and Snohomish Counties has increased by 21%. One must take seasonality into account which elevates that growth, but there has certainly been a recovery in home values in the correction. Sellers are sitting on tons of equity as it was measured in November 2023 that homeowners in King County had at least 60% home equity and 57.5% in Snohomish County. This figure does not take into account the price growth we have seen in 2024 thus far.

So, what does all of this mean going forward? We typically will reach our seasonal peak in prices in May or June. This phenomenon is a result of price growth decelerating due to inventory growth over the second half of the year. The rate of price growth will slow as more homes come to market; this is not price depreciation, but deceleration. Homeowners are standing on the shoulders of immense growth over the last 5 months and need to keep that and the long-term growth in perspective. If the rapid rate of price growth continued, it would not be sustainable and would create market volatility. Moderation and price stability benefit the overall health of the real estate market and economy over prolonged extreme price increases.

As we head into the summer months, I anticipate more selection for buyers which will temper price growth. Sellers will enjoy the gains that have been made over the last 2 years and so far in 2024, not to mention the last 10 years. The recent increase in inventory has given buyers more opportunities to make a move. The constriction we started the year off with was restrictive for some buyers to enter the market and we see that changing. Buyers who were discouraged earlier this year may consider re-engaging so they can benefit from the increase in selection.

As far as interest rates, experts predict they will slowly recede and be dependent on inflation calming which has been stubborn. Affordability has been a dance of balancing home prices, rates, and monthly payments. Some buyers have been creative with rate buy-downs to manage the monthly expense and some are purchasing based on today's rates with the hope of re-financing in the future. A sound piece of advice for buyers is to buy based on payment, not on the peak of what you can qualify for. Your monthly output needs to be sustainable and somewhat comfortable to make sense.

Real estate is an investment and a key component to building wealth. While it might seem scary or risky to make a purchase, the long-term gains are favorable in comparison to other investment vehicles. Plus, you get to live in your home, love your home, and make memories in your home while it creates a nest egg. Life changes create reasons to move. Assessing where you want to be and how it matches your lifestyle is where the decision-making starts. If you have experienced some life changes and are curious about how the market relates to your housing goals, please reach out. It is my goal to help keep my clients informed and empower strong decisions.

As we sit almost five months into 2024 in the middle of the spring market and I reflect on how the year is going, I am grateful, amazed, and locked in on the stats. You see, the last four years since the start of the pandemic have been an eventful and wild ride. 2020 saw a brief halt in sales when the shelter-in-place order went into effect, and once protocols were established to make real estate essential, the market started to take off. Many people utilized that time to re-evaluate where they wanted to live, whether that meant in a different state, from an urban location to a rural setting, or from a shared condo building to a single-family residential house.

This re-organization of where people wanted to live was coupled with historically low interest rates that hovered in the 3% range, leading to the highest number of recorded closed sales in 2020 and 2021 that we had seen in over a decade. All of this activity took place while inflation was on a stubborn uphill trajectory, causing the Fed to make some big rate increases to help combat consumer spending in 2022.

Rates increased by three percentage points from February 2022 (3.9%) to October 2022 (7%) and have remained in that higher range ever since. This quickly put a stall on buyer demand as monthly payments quickly became more expensive, putting downward pressure on affordability. This caused a correction in prices from the peak in spring 2022 to the first quarter of 2023 when prices bottomed out.

In King County, prices corrected from the peak to the bottom by 20%, and in Snohomish County, 17%. Prices started to bounce back from the bottoming out in the spring of 2023, and since then have increased 24% in King County and 13% in Snohomish County. While prices were stabilizing and then growing from Q1 2023 until now, interest rates have hovered in the 7% range. Buyer demand slowly regained its footing throughout 2023 and when the calendar turned to 2024, buyers started to come out in force despite the interest rates never returning to historic lows. It is safe to say that many buyers have accepted the higher interest rates as the new normal.

In this new normal, monthly payments are high as prices remain stable and have had extreme appreciation since the start of 2024. In King County, prices have grown by 16% from Dec 2023 to April 2024 and in Snohomish County by 14%. At the end of 2023, it was reported that the average homeowner had at least 60% home equity in King County and 57.5% in Snohomish County. That equity measurement doesn’t include the price growth we have experienced so far in 2024.

Rates have remained stubborn due to inflation still being a challenge. Inflation has tempered, but not to the 2% year-over-year level the Fed wants to see before easing interest rates. The Fed met at the beginning of May and indicated that rates will slowly come down in the second half of 2024 and into 2025 if inflation rates reach that 2% year-over-year mark. That will be a key marker to track as the Fed Chairman, Jerome Powell has made it clear that will be what it takes to cause rate relief.

Some buyers may wait to enter the market once rates have eased, and many are jumping in now as they are happy to secure today’s prices. Demand will only increase when rates improve, which should most likely cause additional price growth. Creative financing options such as interest rate buy-downs and ARM (Adjustable-Rate Mortgage) loans have helped buyers manage their monthly payments when making a purchase. The key factor I help the buyers I serve stay focused on, is the affordability of their monthly payments.

This focus has proven to be the most productive and strategic number to stay connected with to help a buyer remain confident and effective. Buyers often make adjustments in price point, features, and/or location to match up a manageable monthly payment with the home they buy. Analyzing the trends, stats, and values from one area to the next is an exercise that helps buyers gain clarity. We often say that when a buyer finds a home that matches 75-85% of their criteria they are in striking distance to make an offer. In a seller’s market like this, buyers must make compromises to succeed.

A bright light for buyers is that we have seen a recent jump in new listings. There were 30% more new listings in April 2024 over April 2023 in King County and 32% more in Snohomish County. With seller equity so high and pent-up seller motivation boiling over, we are finally starting to see additional inventory come to market. We are still experiencing tight inventory, but it is growing. This is providing some additional selection and should hopefully continue throughout 2024.

Continuing my daily, weekly, monthly, and annual commitment to studying the market is a benefit to the clients I serve. Understanding how inventory, rates, and prices all relate to each other helps me provide valuable insights for clients so they can appropriately strategize when they want to enter the market. These trends vary from one city to the next, in different price points and property types. If you are curious about how today’s trends relate to your real estate goals, please reach out. Further, if you know someone who needs my assistance, please direct them my way. It is my goal to help keep my clients well-informed to empower strong decisions.

|

|

Since 1984, Windermere associates have dedicated a day of work to complete neighborhood improvement projects as part of Windermere’s Community Service Day. After all, real estate is rooted in our communities. And an investment in our neighborhoods gives us all a better place to call home.

Our annual Community Service Day is coming up fast. On June 7th, my whole office will spend the day working to put fresh produce on the tables of local families who need a little help. We will work with the Snohomish Garden Club, planting over a half-acre of veggies and fruits that will be harvested into thousands of pounds of fresh produce over the summer and into the fall.

If you or someone you know has any vegetable starts or seeds you’d like to donate, please reach out!

|

|

The real estate industry has been in the news a bit lately. Not so much about the trends and home values. More so about class action lawsuits, which have stolen a lot of attention away from the positive activity that is happening in our market. While the lawsuit is an important story to track, one critical item to mention is that WA has already complied with the majority of what the proposed lawsuit settlement is suggesting.

New laws went into place on Jan 1, 2024, that complemented changes our MLS started making in 2019. We have been smooth sailing for almost four months bringing heightened transparency to every real estate transaction we do with new laws, forms, and procedures. The national hype has caused a stir, so before I get into the three important trends, I wanted to let you know that WA is ahead of the curve. If you have any questions on how to distinguish the national headlines from the local truth, please don’t hesitate to contact me.

Inflation has been a hot topic for a few years now. We all know the cost of groceries, gas, and everyday items are higher than they were just a few years ago. This caused interest rates to increase in spring 2022, hovering between 6.25-7.5% over the last 2 years. Despite these rate increases we have watched the real estate market and home values recover and start to appreciate again. The median price in Snohomish County is up 5% in Q1 2024 over Q1 2023 and up 13% in King County. The spring market has sprung!

The lending costs to purchase a home have increased and it has limited and sidelined some buyers. However, many are finding ways to make it work and demand is strong with the return of multiple offers and price escalations on well-priced and presented listings. If you are waiting for rates to come down, also pay attention to prices as it is a delicate balance of affordability. The option to re-finance your interest rate down the road if rates dip will decrease your monthly payment while keeping your loan balance fixed.

Homeowners Insurance has also been hit hard by inflation and a heightened amount of claims over the last four years. Natural disasters such as fires, floods, and earthquakes have depleted many insurance companies’ reserves causing them to re-calibrate their rates across the board to keep up. You may have seen an increase in your rate. With home values and goods on the rise, it is important that you have your home and belongings adequately insured.

I’d suggest you check in with your carrier to make sure they have your home and your belongings properly valued. With market dynamics quickly shifting I’d caution you from grabbing your home value from an online estimator such as Zillow or your insurer’s automated program. Those algorithms are most often inaccurate which could leave you under-insured. I’m happy to help you assess the current value of your home in today’s market so you can properly calibrate your homeowner’s insurance in this volatile insurance environment.

According to ATTOM data, 67.4% of homeowners in the U.S. have at least 50% home equity, with 38.7% owning their homes free and clear. Locally, the average homeowner in Snohomish County has 57.5% home equity, and in King County 60%. Those local figures were reported in Q4 2023 and we have seen a jump in values since then indicating that those figures are now higher.

The point is that home equity is strong for many homeowners, which allows homeowners who are looking to make a move to use creative options to make those moves smooth. We are in a competitive seller’s market so trying to purchase a home contingent on the sale of your current home is a challenging feat. At Windermere, we have the awesome Windermere Bridge Loan Program (WBLP) that helps people tap into their equity to make their next purchase instead of having to sell their homes first.

The WBLP does not require an appraisal like a Home Equity Line of Credit (HELOC), is quickly approved, and does not require monthly payments. The loan balance and any accrued interest are paid off when the collateral property is sold, allowing buyers who are also sellers to easily utilize their equity and not have to move twice. I’ve even seen the collateral property close first if strategized properly. This eliminates having to fund the Bridge Loan altogether, yet it was used to make that buyer’s offer competitive and helped them win the house for their next chapter in life.

One of the biggest tasks I assist clients with is preparing their homes for the market. How a home comes to market can make a huge difference in the bottom line. Remedying deferred maintenance, making home improvements, remodeling, clean-up, purging, and merchandising can all contribute to a seller making more money on closing day. Creating a punch list of items that will create the most favorable return is a service I provide my clients.

Identifying the available funds, hiring service providers, and just getting started can cause overwhelm and sometimes paralysis. As stated above, many homeowners have amazing home equity. Leveraging home equity can help a homeowner complete the projects that will make a better profit! At Windermere, we have the Windermere Ready Program (WRP) which allows home sellers to tap into their equity before coming to market to get their homes market-ready.

Like the WBLP, the WRP is quickly approved, does not require an appraisal, and monthly payments are not required. We figure out which projects we want to focus on, gather bids from trusted contractors, create a budget, and apply. The funds are provided within 2 weeks and we can line up the work and start the transformation immediately.

I’ve seen simple flooring replacements and fresh paint transform a house. We’ve even done a full kitchen remodel to completely change up the vibe. The projects that warm my heart are helping elderly sellers sort through years of living and clearing the space for potential buyers to envision themselves in the home. Did you know that there are companies that help people sort and purge their belongings, so they are prepared to move on to their next chapter? Lastly, we can solve property issues with the WRP! Earlier this year, we discovered a failed septic system on a listing and we were able to utilize the WRP to tackle that fix and made it to the closing table at top dollar.

Markets are fast-paced and dynamic! Helping clients navigate the environment to protect their investment, strategize financing, and/or prepare their property are tasks that I take very seriously. Even if it is as simple or complicated as clearing a house for the market. Whether we are evaluating these items for an immediate move or we are planning out years in the future providing this care matters to me! Please reach out if you or someone you know are curious about how the trends relate to their situation. It is my mission to help keep my clients well informed to empower strong decisions.

|

|

|

Shred Day & Food Drive was a Huge Success!

Big thank you to everyone who came by to utilize our free shredding services and drop off food or cash donations for the Volunteers of America Western Washington food banks!

We filled two trucks of shredding and collected over 1,700 pounds of food and $2,493 which will go to our neighbors in need. Thank you for your generosity!

Next up, is our Summer Food Drive that will coincide with our Annual Windermere Community Service Day where we will volunteer for a day with the Snohomish Garden Club planting fruits and veggies for the VOA Food Banks. |

|

When Punxsutawney Phill climbed up to his perch at Gobblers Knob on February 2nd and did not see his shadow, an early spring was predicted. Little did we know that he would be referring to the real estate market! As we experience temps in the 30s and scattered snow showers in the first week of March, we are also experiencing a white-hot seller’s market.

We started 2024 with the lowest amount of inventory we have seen since the beginning of 2022. Over the last 2 years, we have experienced a correction and recovery in the real estate market due to inflation and interest rates. The market peaked in April 2022 in Snohomish County when the median price reached $830,000, and in May 2022 in King County when prices reached $1M. Prices started to correct when rates crested 5% in April 2022 and then found themselves squarely at 7% by October 2022. This rapid 2-point increase put downward pressure on prices and stalled buyer and seller demand.

Loan servicing affordability  caused prices to bottom out in Snohomish County in February 2023 at $685,000, and in King County in January 2023 at $800,000. The bulk of the correction took place in 2022, and 2023 was the year of resetting price stability and the return of appreciation. What was fascinating about this growth is that interest rates still averaged around 7% throughout 2023. caused prices to bottom out in Snohomish County in February 2023 at $685,000, and in King County in January 2023 at $800,000. The bulk of the correction took place in 2022, and 2023 was the year of resetting price stability and the return of appreciation. What was fascinating about this growth is that interest rates still averaged around 7% throughout 2023.

In Snohomish County prices were up 6% in February 2024 over February 2023, and in King County they were up 16%, and rates are still hanging around 7%. Since the first of the year, it was like a switch went off for many buyers and demand flooded the market. The feedback that I am hearing is that many buyers have adapted to the new normal of interest rates and will refinance when rates come down; but they want to buy now. The increase in buyer demand coupled with the lowest inventory we’ve seen in two years has caused a flurry of multiple offers, price escalations, and an early start to the spring market.

Now that we are certain buyers are back, the next effective change in the market would be the addition of more inventory. This would meet the demand and create more movement in the market. We are well aware that many homeowners are reluctant to make a move because they don’t want to give up their low rate/payment. We also know that because of this, many would-be sellers are living in homes that do not match their needs and wants.

This pent-up seller demand is starting to come to market, but more is needed. The average level of equity in Snohomish County was reported at the end of 2023 at 57.5% and in King County at 60%. With the recent uptick in median price, this level is growing, which will allow many sellers to move their equity into a home that better fits their lifestyle. This growth should also be supported by interest rates slowly coming down throughout 2024.

The latest predictions from the Home Price Expectation Survey (HPES) have rates decreasing to 6% by the end of 2024 which will only add to buyer demand, highlighting the need for more listings. If you are a homeowner and your house is not matching your life, now might be the time to consider a move! What has already transpired in the first 2 months of 2024 has been encouraging for seller gains.

Writing a playbook and creating a strategy to make these transitions requires a well-curated plan. It is my mission and passion to help clients make these moves. There can be challenges to overcome along the way, such as does one sell or buy first and how to do you get your home ready for market. Tools such as the Windermere Bridge Loan, The Windermere Ready Loan, and other alternative financing have helped make these dreams become a reality. That is why hiring a professional who is well-versed in market knowledge, creative planning, expert marketing, and keen negotiations is key!

Please reach out if you or someone you know is curious about the market and how it relates to your financial and lifestyle goals. Real estate reflects life and if there is one constant in life, it is change! Helping people match their homes to their lives is one of the most rewarding aspects of my job. The adjustments over the past two years got in the way of many people making those matches. As the market and consumer confidence continue to open up, don’t let this opportunity pass you by. It is my goal to help keep my clients well-informed and empower strong decisions whether that works for you now or sometime down the road. Let’s talk it out, dig deep into the trends, and start your strategic planning with no pressure.

|

|

| You’re invited to our annual Paper Shredding Event & Food Drive. We partner with Confidential Data Disposal (CDDshred.com) to provide a safe, eco-friendly way to reduce your paper trail and help prevent identity theft.

Saturday, April 13th, 10AM to 2PM (or until the trucks are full)

4211 Alderwood Mall Blvd, Lynnwood

Bring your sensitive documents to be professionally destroyed on-site. Limit 10 file boxes per visitor.

This is a paper-only event. No x-rays, electronics, recyclables, or any other materials.

We will also be collecting non-perishable food and cash donations to benefit Volunteers of America Western Washington food banks. Donations are not required, but are appreciated.

Hope to see you there! |

|

Effective January 1, 2024, the statute in Washington that governs real estate brokerage relationships (RCW 18.86) otherwise known as the “Agency Law” – was significantly revised. The revisions modernize the 25-year-old law, provide additional transparency and consumer protections, and acknowledge the importance of buyer representation.

Effective January 1, 2024, the statute in Washington that governs real estate brokerage relationships (RCW 18.86) otherwise known as the “Agency Law” – was significantly revised. The revisions modernize the 25-year-old law, provide additional transparency and consumer protections, and acknowledge the importance of buyer representation.

KEY REVISIONS

For decades, real estate brokerage firms were only required to enter into written agency agreements with sellers, not buyers. The Agency Law now requires firms to enter into a written “brokerage services agreement” (agency agreements) with any party the firm represents, both sellers and buyers.

This change is to ensure that buyers (in addition to sellers) clearly understand the terms of the firm’s representation and compensation, much like a listing agreement. The new agreements are called Buyer Brokerage Service Agreements (BBSA) and they are to be initiated in writing prior to or upon rendering real estate brokerage services, such as showing homes.

The services agreement with buyers must include:

- The term of the agreement (with a default term of 60 days and an option for a longer term);

- The name of the broker appointed to be the buyer’s agent;

- Whether the agency relationship is exclusive or non-exclusive;

- Whether the buyer consents to the individual broker representing both the buyer and the seller in the same transaction (referred to as “limited dual agency”);

- Whether the buyer consents to the broker’s designated broker/managing broker’s limited dual agency;

- The amount the firm will be compensated and who will pay the compensation; and

- Any other agreements between the parties.

Clearly communicated expectations between the buyer and their broker are an advantage to the buyer. Every party deserves representation and it has been a long time coming for the law to pay as much attention to buyers as it has to sellers. Having competent representation on both sides of a transaction makes the process go smoother and reduces liability during and after the transaction. After all, everyone deserves competent representation during one of the biggest transactions they will partake in.

These changes are intended to elevate transparency in agency relationships for the consumer and encourage more detailed conversations about representation, compensation, and the overall home buying process with the broker they chose to align with. This will also cause sellers to gain a better understanding of how buyer brokers are compensated.

What a seller chooses to offer a buyer broker could have a positive effect on their return. The only way a buyer can compensate their broker is with liquid cash or negotiating with the seller within the purchase and sale agreement when their BBSA doesn’t match the seller-offered compensation for the buyer broker. If their BBSA matches what the seller is offering in the listing for the buyer broker compensation, then the buyer does not have to rely on the prior.

Compensation offered in a listing that mirrors the BBSA will allow a buyer to solely focus on the offer price of the home as they will not have to calculate the math of the compensation against their down-payment funds, as lending regulations do not allow for broker compensation to be financed. If a buyer has to set aside funds for compensation it would likely reduce their down payment amount which would increase their monthly payment and make them more price sensitive. It will also eliminate the compounding effect of compensation and the offer price being simultaneously negotiated.

I have always run my business in a very detailed fashion and pride myself on having a deep knowledge of the laws and the forms, and these changes are paramount. As an independent contractor affiliated with Windermere Real Estate, the leading company in our region, it is up to me to dig into the research and gain understanding to help guide my clients through these advancements in a compliant and service-oriented fashion. There are even aspects of these new laws that I have been practicing before the changes, as transparency is a cornerstone of my value to my clients.

These are the biggest changes we have seen in our industry in over two decades. Be aware that not all brokers will adapt as quickly or accurately. We are already seeing a gross difference between the informed and not informed; who one chooses to work with matters! If you have any further questions about how these new laws affect you, please reach out. If you are considering a move, I am committed to navigating the process with the utmost compliance and my client’s success at the forefront.

REVISED PAMPHLET: The pamphlet entitled “Real Estate Brokerage in Washington” provides an overview of the revised Agency Law.

REVISED AGENCY LAW: Substitute Senate Bill 5191 sets forth the revised Agency Law in its entirety.

Last week, my office hosted our 16th Annual Economic Forecast Event featuring Matthew Gardner. Matthew is a sought-after economist focused on the national and local economies and has a deep understanding of the housing market across the country and right in our own backyard. He is an economic advisor for the State of Washington, Governors Council, lectures on real estate economics at the University of Washington, and is found quoted in various media outlets throughout the year as a respected expert. He is certainly a trusted real estate advisor that I look to to stay informed to help educate my clients.

The event was virtual and I have the recording and his PowerPoint in a PDF that I am happy to share with you, please reach out if you would like me to email it to you. So much was shared in his 60-minute presentation that was focused on the national economy and a deep dive into both King and Snohomish Counties, followed by Q & A. I can’t quite cover it all here, but here are some highlights!

1. Inflation levels have dropped from their peak and are now tracking with more normalized levels. This has caused interest rates to start to drop, which is a trend he sees continuing in 2024.

2. The U.S. unemployment rate measured at 3.8% at the end of 2023 and is forecasted to rise ever so slightly and remain under the long-term average of 4.5%. In King and Snohomish Counties the unemployment rate averaged 4% at the end of 2023.

3. There is a major labor gap in both King and Snohomish Counties, with job postings heavily outweighing labor supply. Biotech is the darling of the moment which will balance out the IT side in the overall jobs picture.

4. Interest rates are predicted to gradually decrease throughout 2024 as inflation softens. The Fed will slow-play these reductions to get them right, so they do not have to raise them again.

5. The Tri-County area of Snohomish-King-Pierce Counties had massive organic population growth from 2020-2022, much of which was international vs. domestic.

6. Homeowner equity averages 60% in King County and 57.5% in Snohomish County. According to the median price in King County in December 2023 that is $511,200 and $391,000 in Snohomish County. Homeownership proves to have the strongest impact on household wealth.

7. There will NOT be a bubble in the housing market! Given that prices remained stable in 2023 amongst the highest interest rates we’ve seen in two decades along with inflation at a high, the housing market has proven to be a fortuitous economic marker. Rates and inflation are both improving, which will bode well for home values. Our biggest challenge is the lack of inventory and affordability.

8. Price growth in King and Snohomish Counties was flat year-over-year (2022 to 2023) after massive growth from 2020-2022, which was positive given the correction in prices and rise in interest rates. Prices are forecasted to modestly increase in 2024. Tight inventory and continued buyer demand will drive this growth while interest rates temper.

Please reach out if you would like to learn more and receive the documents and recording. Also, you can count on me to follow the trends, statistics, and rhythm of the market throughout the year. It is my goal to gain knowledge and understanding so I can help keep you informed. This level of service helps empower my clients to make thoughtful, sound decisions when navigating their investments and big life choices.

Cell: 425.772.3783 | JillLanger@windermere.com

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data. With over 30 years of professional experience, he provides valuable insights into the real estate industry and housing market, including quarterly regional reports, monthly videos, and timely analysis of the latest trends. Below the Top 10, you will find information inviting you to the live, virtual Economic Forecast Event I am hosting in January. Please reach out if you would like to attend.

1. Still no housing bubble

This was number one on my list last year and, so far, my forecast was spot on. The reason why I’m calling it out again is because the market performed better in 2023 than I expected. Continued price growth, combined with significantly higher mortgage rates, might suggest to some that the market will implode in 2024, but I find this implausible.

2. Mortgage rates will drop, but not quickly

The U.S. economy has been remarkably resilient, which has led the Federal Reserve to indicate that they will keep mortgage rates higher for longer to tame inflation. But data shows inflation and the broader economy are starting to slow, which should allow mortgage rates to ease in 2024. That said, I think rates will only fall to around 6% by the end of the year.

3. Listing activity will rise modestly

Although I expect a modest increase in listing activity in 2024, many homeowners will be hesitant to sell and lose their current mortgage rate. The latest data shows 80% of mortgaged homeowners in the U.S. have rates at or below 5%. Although they may not be inclined to sell right now, when rates fall to within 1.5% of their current rate, some will be motivated to move.

4. Home prices will rise, but not much

While many forecasters said home prices would fall in 2023, that was not the case, as the lack of inventory propped up home values. Given that it’s unlikely that there will be a significant increase in the number of homes for sale, I don’t expect prices to drop in 2024. However, growth will be a very modest 1%, which is the lowest pace seen for many years, but growth all the same.

5. Home values in markets that crashed will recover

During the pandemic, there were a number of more affordable markets across the country that experienced significant price increases, followed by price declines post-pandemic. I expected home prices in those areas to take longer to recover than the rest of the nation, but I’m surprised by how quickly they have started to grow, with most markets having either matched their historic highs or getting close to it – even in the face of very high borrowing costs. In 2024, I expect prices to match or exceed their 2022 highs in the vast majority of metro areas across the country.

6. New construction will gain market share

Although new construction remains tepid, builders are benefiting from the lack of supply in the resale market and are taking a greater share of listings. While this might sound like a positive for builders, it’s coming at a cost through lower list prices and increased incentives such as mortgage rate buy-downs. Although material costs have softened, it will remain very hard for builders to deliver enough housing to meet the demand.

7. Housing affordability will get worse

With home prices continuing to rise and the pace of borrowing costs far exceeding income growth, affordability will likely erode further in 2024. For affordability to improve, it would require either a significant drop in home values, a significant drop in mortgage rates, a significant increase in household incomes, or some combination of the three. But I’m afraid this is very unlikely. First-time home buyers will be the hardest hit by this continued lack of affordable housing.

8. Government needs to continue taking housing seriously

The government has started to take housing and affordability more seriously, with several states already having adopted new land use policies aimed at releasing developable land. In 2024, I hope cities and counties will continue to ease their restrictive land use policies. I also hope they’ll continue to streamline the permitting process and reduce the fees that are charged to builders, as these costs are passed directly onto the home buyer, which further impacts affordability.

9. Foreclosure activity won’t impact the market

Many expected that the end of forbearance would bring a veritable tsunami of homes to market, but that didn’t happen. At its peak, almost 1-in-10 homes in America were in the program, but that has fallen to below 1%. That said, foreclosure starts have picked up, but still remain well below pre-pandemic levels. Look for delinquency levels to continue rising in 2024, but they will only be returning to the long-term average and are not a cause for concern.

10. Sales will rise but remain the lowest in 15 years

2023 will likely be remembered as the year when home sales were the lowest since the housing bubble burst in 2008. I expect the number of homes for sale to improve modestly in 2024 which, combined with mortgage rates trending lower, should result in about 4.4 million home sales. Ultimately though, demand exceeding supply will mean that sellers will still have the upper hand.

|

|

Are you curious about the economy during these changing times?

Are you trying to make financial plans, but crave credible information to assist you?

Please join me for a very special virtual live event:

AN ECONOMIC FORECAST FOR 2024 & BEYOND

with Matthew Gardner

Chief Economist for Windermere Real Estate

Wednesday, January 17, 2024 • 6:30 pm – 8 pm

Presentation from 6:30-7:30 pm, Q&A to follow

Please RSVP to me via text 425-772-3783, or email jilllanger@windermere.com by January 12th, 2024 to receive an emailed link to access the event.

|

|

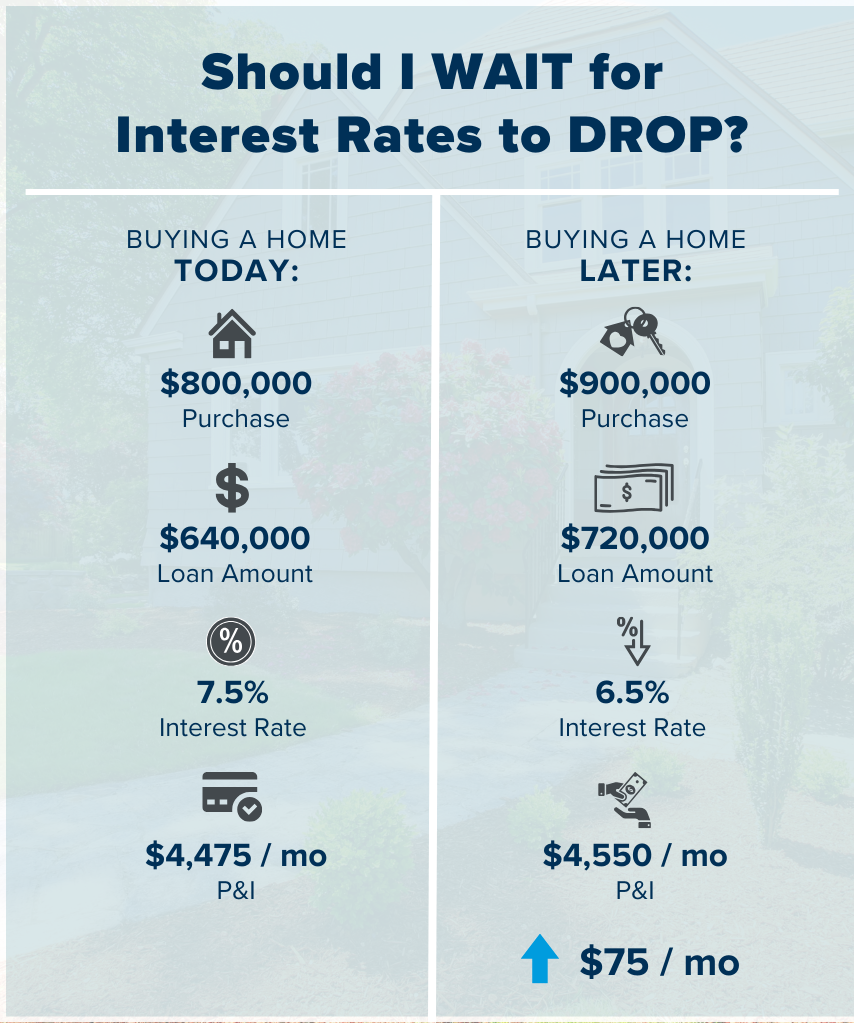

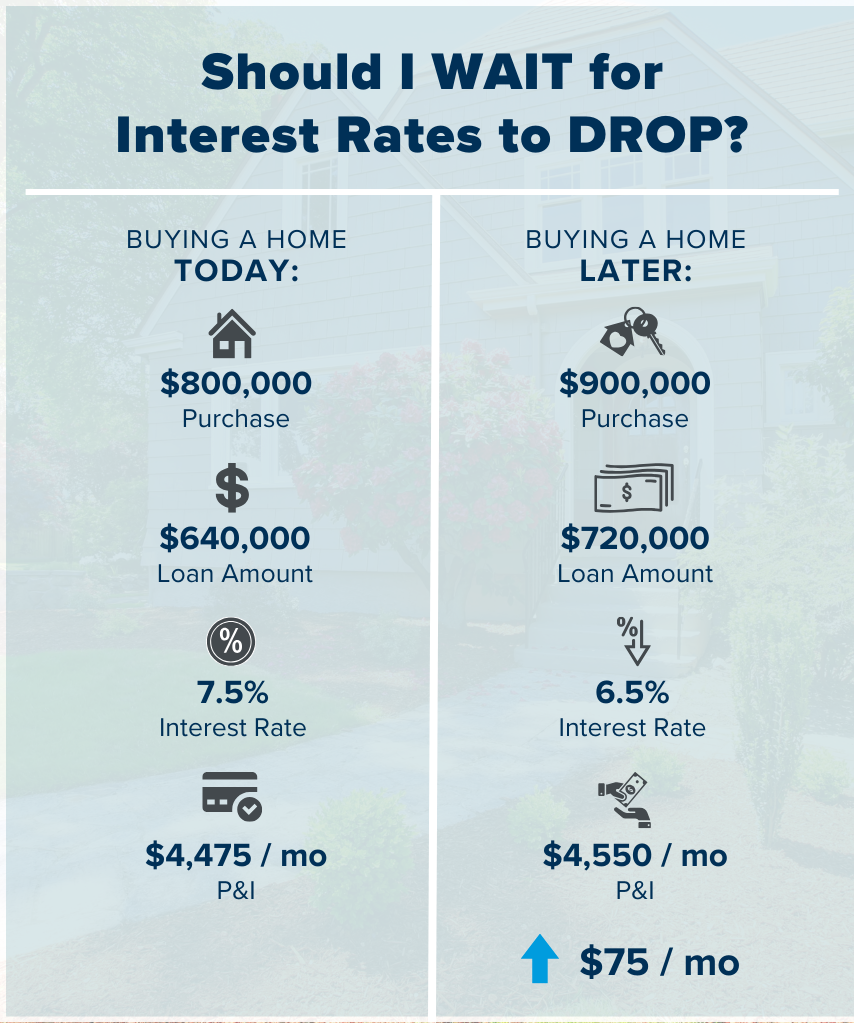

The question that many potential buyers are asking themselves right now is: should I wait for rates to drop before I buy? Higher interest rates have certainly made monthly payments higher and challenged overall affordability, however it is important to consider creative financing options and what the impact on prices will be once rates lower.

Experts predict rates to decrease over the next 12-18 months. In fact, we have seen rates drop half a point over the last 30 days. Currently, the 30-year conventional rate is hovering about 7.5%. We saw a correction in prices when rates jumped by a point and crested 6% in mid-2022. Since Dec 2022, prices found their bottom, and price appreciation started happening again. Year-to-date, the average interest rate has been around 7% and prices have not been in a free fall, they have grown and remain stable.

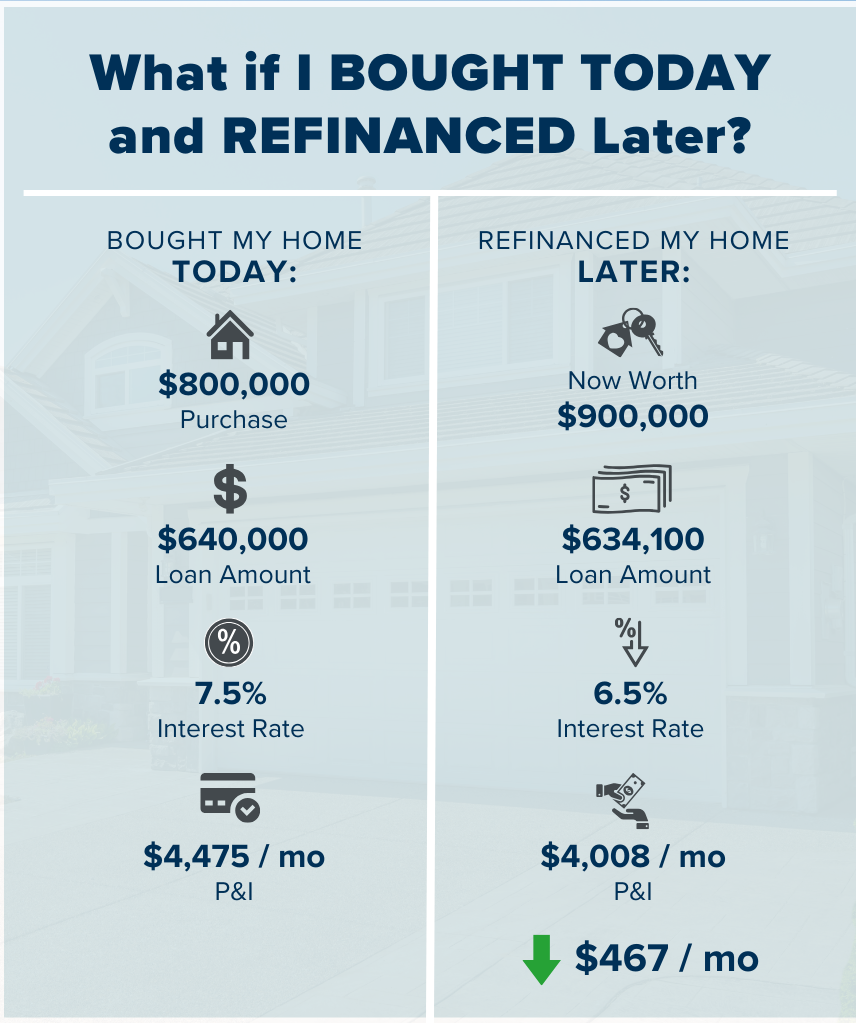

Just like the correction that happened in 2022, it is safe to say there is a correlation between prices and rates. If the experts are correct and rates fall over the course of the next year or so, we should anticipate prices to increase. That is what hangs in the balance when making the decision of whether to buy now or later. The example to the right shows the effect that price appreciation will have despite rates being lower. It was not that long ago that we were experiencing bidding wars where homes escalated in the double digits. As you can see, the higher price results in a higher payment even with the lower rate.

the effect that price appreciation will have despite rates being lower. It was not that long ago that we were experiencing bidding wars where homes escalated in the double digits. As you can see, the higher price results in a higher payment even with the lower rate.

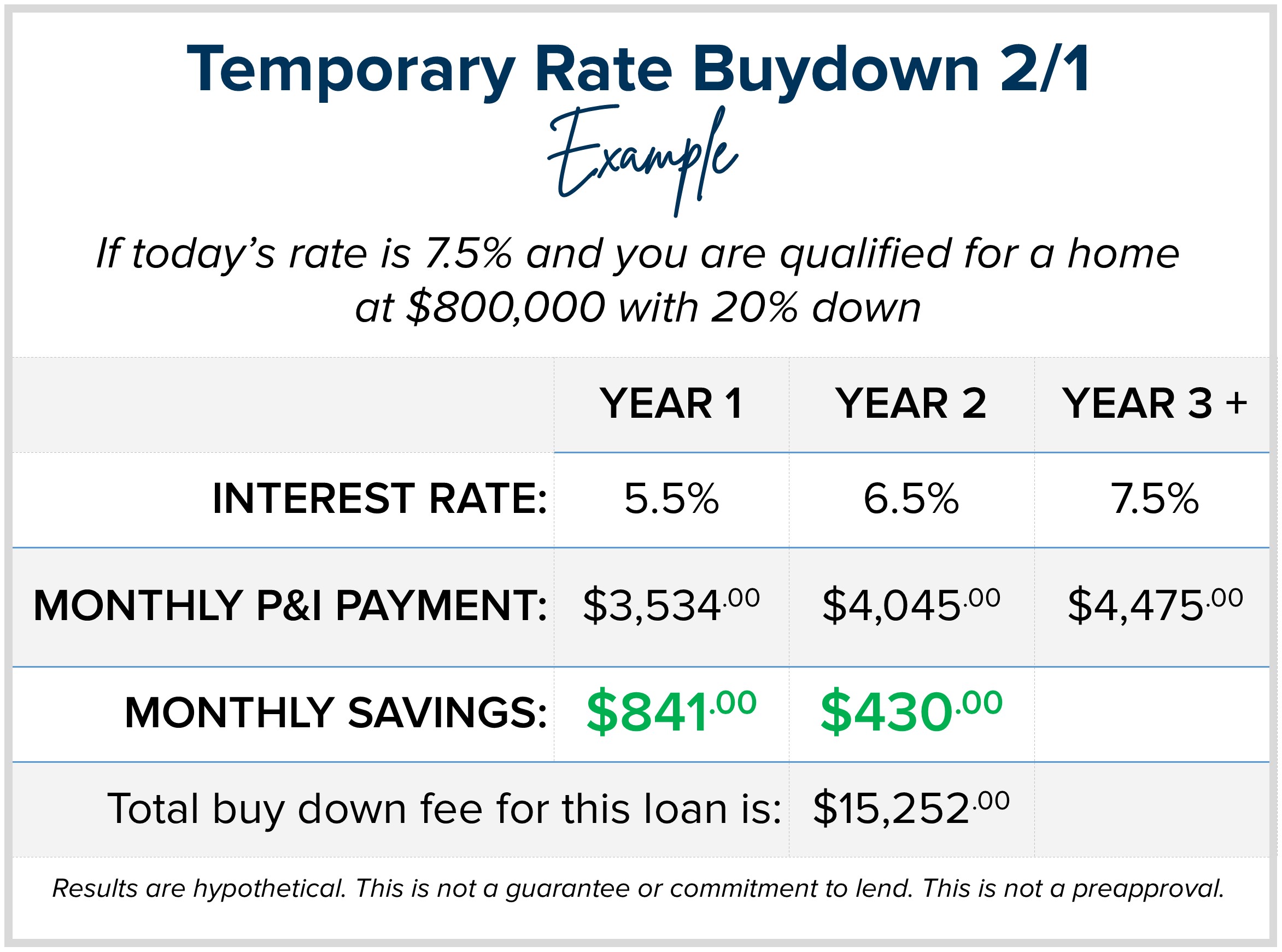

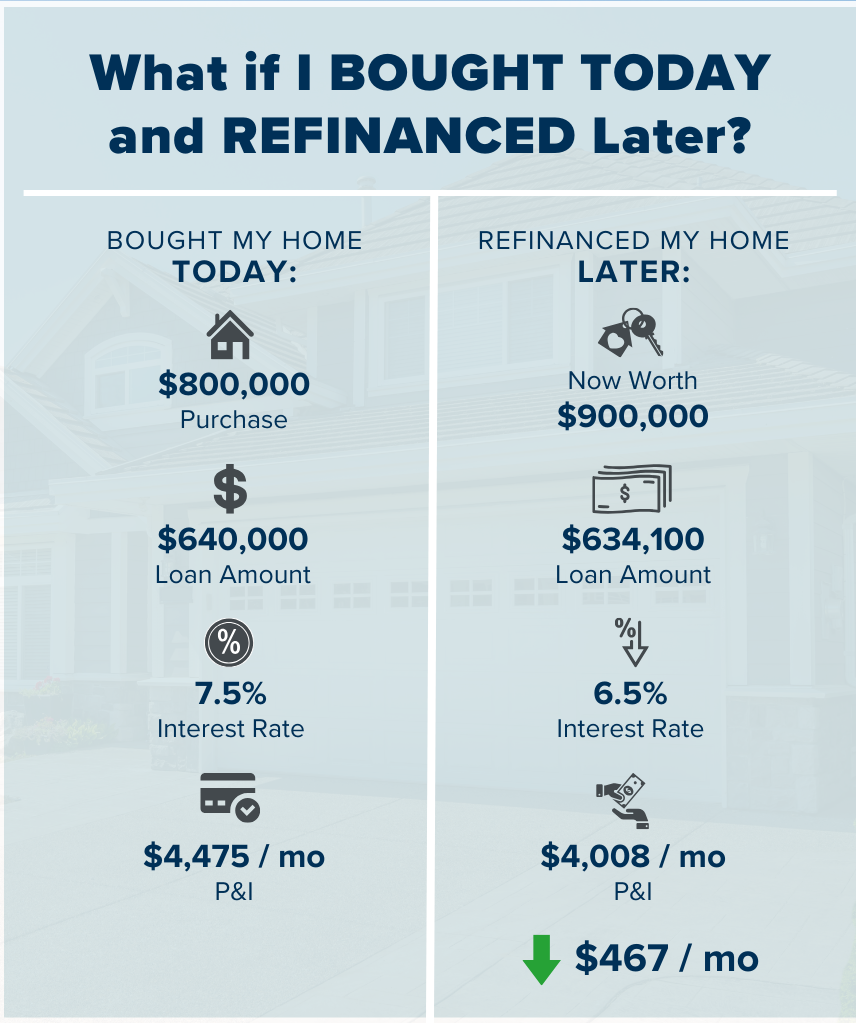

If one is able to afford a purchase now with today’s rate, they can refinance when rates go down and save themselves a lot of money on their payment while keeping a fixed price. Additionally, if a buyer can secure a rate buydown, such as a 2-1 buydown, the higher rates can be overcome and a refinance can fix the rate when the rates drop.

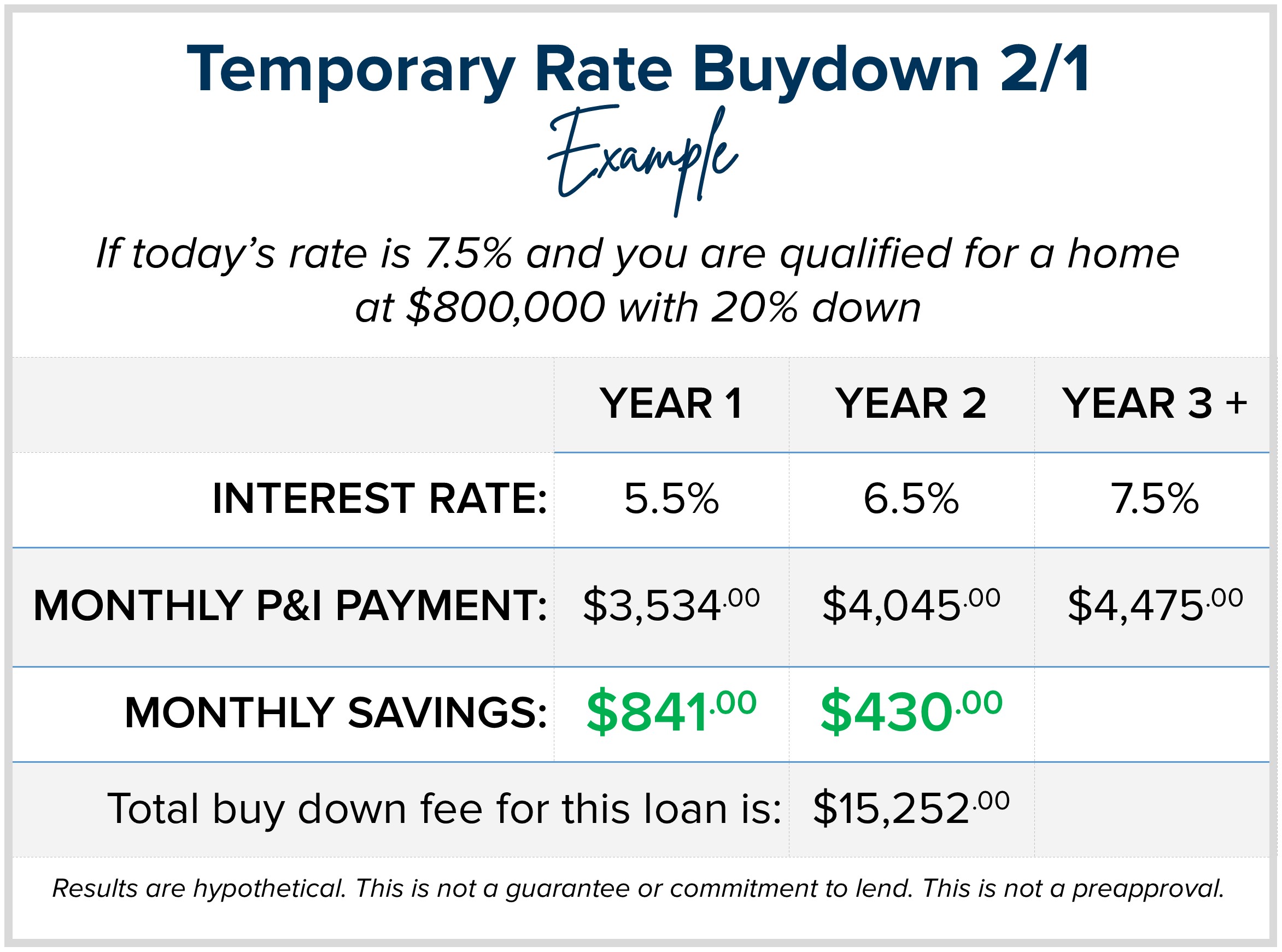

Here is an example: let’s say you are shopping for a house and have the same $800,000 budget and a 20% down payment with today’s rate of 7.5%. The monthly principal and interest payment would be $4,475.00. You could do a 2-1 buydown (2-points lower in year one and 1-point lower in year 2) which would have your payment in year one be based on an interest rate of 5.5% with a monthly principal and interest payment of $3,534 – a savings of $841.00 per month. For year two, the monthly principal and interest would be based on 6.5% resulting in a monthly payment of $4.045.00, a $430.00 per month savings. The total savings in monthly payments with the 2-1 buy-down over the two years would be $15,252.00.

The roughly $15,000 in monthly payment savings is paid upfront at closing and in some cases paid by the seller. The buyer still needs to qualify based on the 7.5% interest rate as the payments will convert to the payment based on the 7.5% in year three moving forward. The strategy here is to never have the payment increase to 7.5% because the buyer plans to refinance when rates come down, and will permanently fix their rate below 7.5%. A bonus is that if the entire $15,000 credit has not been used yet, in some cases those funds can be applied towards the refinance.

You see, there are many options to consider when a buyer is balancing rates, prices, payments, and their desire to make a move. I understand that I am in the business of helping people navigate big life changes while ensuring their financial investment is sound. I felt it was an important message to share these examples in case you or someone you know was thinking about making a purchase but was feeling confused or stifled by the current rate environment. If you want to learn more or need a referral to a reputable lender, please reach out. It is always my goal to help keep my clients well-informed and empower strong decisions.

The question that many potential buyers are asking themselves right now is: should I wait for rates to drop before I buy? Higher interest rates have certainly made monthly payments higher and challenged overall affordability, however it is important to consider creative financing options and what the impact on prices will be once rates lower.

Experts predict rates to decrease over the next 12-18 months. In fact, we have seen rates drop half a point over the last 30 days. Currently, the 30-year conventional rate is hovering about 7.5%. We saw a correction in prices when rates jumped by a point and crested 6% in mid-2022. Since Dec 2022, prices found their bottom, and price appreciation started happening again. Year-to-date, the average interest rate has been around 7% and prices have not been in a free fall, they have grown and remain stable.

Just like the correction that happened in 2022, it is safe to say there is a correlation between prices and rates. If the experts are correct and rates fall over the course of the next year or so, we should anticipate prices to increase. That is what hangs in the balance when making the decision of whether to buy now or later. The example to the right shows the effect that price appreciation will have despite rates being lower. It was not that long ago that we were experiencing bidding wars where homes escalated in the double digits. As you can see, the higher price results in a higher payment even with the lower rate.

If one is able to afford a purchase now with today’s rate, they can refinance when rates go down and save themselves a lot of money on their payment while keeping a fixed price. Additionally, if a buyer can secure a rate buydown, such as a 2-1 buydown, the higher rates can be overcome and a refinance can fix the rate when the rates drop.

Here is an example: let’s say you are shopping for a house and have the same $800,000 budget and a 20% down payment with today’s rate of 7.5%. The monthly principal and interest payment would be $4,475.00. You could do a 2-1 buydown (2-points lower in year one and 1-point lower in year 2) which would have your payment in year one be based on an interest rate of 5.5% with a monthly principal and interest payment of $3,534 – a savings of $841.00 per month. For year two, the monthly principal and interest would be based on 6.5% resulting in a monthly payment of $4.045.00, a $430.00 per month savings. The total savings in monthly payments with the 2-1 buy-down over the two years would be $15,252.00.

The roughly $15,000 in monthly payment savings is paid upfront at closing and in some cases paid by the seller. The buyer still needs to qualify based on the 7.5% interest rate as the payments will convert to the payment based on the 7.5% in year three moving forward. The strategy here is to never have the payment increase to 7.5% because the buyer plans to refinance when rates come down, and will permanently fix their rate below 7.5%. A bonus is that if the entire $15,000 credit has not been used yet, in some cases those funds can be applied towards the refinance.

You see, there are many options to consider when a buyer is balancing rates, prices, payments, and their desire to make a move. I understand that I am in the business of helping people navigate big life changes while ensuring their financial investment is sound. I felt it was an important message to share these examples in case you or someone you know was thinking about making a purchase but was feeling confused or stifled by the current rate environment. If you want to learn more or need a referral to a reputable lender, please reach out. It is always my goal to help keep my clients well-informed and empower strong decisions.

New Agency Law Changes: Transparency, Consumer Protection, & Commitment

On January 1, 2024, major changes to the Law of Agency will go into effect. These changes result from the real estate industry in the state of Washington wanting to elevate the level of transparency and consumer protection surrounding buyer representation. Senate Bill 5191 was voted into law requiring adjustments in how brokers operate when working with buyers.

The seller side of a transaction has always required a separate contract (a Listing Agreement) that outlines the representation, compensation, and the level of commitment the buyer and broker have to each other. It has always been a bit shocking to me that the state did not require such a contract for a buyer and broker. Under new legislation set to take effect on January 1, 2024, buyers and brokers will be required to have a signed contract – a Buyer Brokerage Service Agreement (BBSA). This new contract will provide a consistent and professional guidepost to help everyone understand the buyer and broker relationship, just like a seller and broker do when they enter into a listing agreement.

Buying a house is not an easy task, nor is guiding someone successfully through the process. It is about time the law sets a clear explanation of how buyer representation works and encourages a clearly communicated partnership. I've always believed that having consistent processes in my business leads to a better outcome for my clients. This advancement for our industry will elevate these processes and in turn, raise the bar.

Key Revisions

For years, real estate brokerage firms were only required to enter into written agreements with sellers, not buyers. Beginning on January 1, 2024, the Agency Law will require firms to enter into a written “brokerage services agreement” with any party the firm represents, both sellers and buyers. This change is to ensure that buyers (in addition to sellers) clearly understand the terms of the firm’s representation and compensation.

The services agreement with buyers must include:

• The term of the agreement (how long the buyer and broker are committed to working together);

• The name of the broker appointed to be the buyer’s agent;

• Whether the agency relationship is exclusive or non-exclusive;

• Whether the buyer consents to the individual broker representing both the buyer and the seller in the same transaction (referred to as “limited dual agency”);

• Whether the buyer consents to the broker’s designated broker/managing broker’s limited dual agency;

• The amount the firm will be compensated and who will pay the compensation; and

• Any other agreements between the parties.

All of these options are outlined in the new BBSA contract and will be presented and discussed before deciding to embark on the home-buying journey together. It will eliminate any guesswork and encourage a strong work relationship surrounding an incredibly important task. This will help my clients understand my level of commitment and professionalism, and how I help my clients achieve effective results.

I have provided the links to the new Agency Pamphlet and the revisions to Senate Bill 5191 below for your review. If you have any questions or are thinking about making a purchase in 2024, please reach out. It is always my goal to help keep my clients well-informed and empower strong decisions. I am happy to bring this information to you ahead of the change, so you are well prepared should you have any real estate changes coming your way in the future.

Revised Pamphlet. The pamphlet entitled “Real Estate Brokerage in Washington” provides an overview of the revised Agency Law.

Revised Agency Law. Substitute Senate Bill 5191 sets forth the revised Agency Law in its entirety.

Check out the latest "Mondays with Matthew" (Matthew Gardner, Windermere's Chief Economist) that addresses inventory levels, interest rates, existing home sales, and the price stability we have experienced since the first of the year. Despite higher interest rates, historically low inventory has kept prices stable!

Please note that I will be hosting a Virtual Economic Forecast Event with Matthew on the evening of Wednesday, January 17th, 2024. There will be a lot to cover as 2023 was a transitional year and 2024 is an election year! Be on the lookout for more information and save the date if you would like to attend.

Effective January 1, 2024, the statute in Washington that governs real estate brokerage relationships (RCW 18.86) otherwise known as the “Agency Law” – was significantly revised. The revisions modernize the 25-year-old law, provide additional transparency and consumer protections, and acknowledge the importance of buyer representation.

Effective January 1, 2024, the statute in Washington that governs real estate brokerage relationships (RCW 18.86) otherwise known as the “Agency Law” – was significantly revised. The revisions modernize the 25-year-old law, provide additional transparency and consumer protections, and acknowledge the importance of buyer representation.

the effect that price appreciation will have despite rates being lower. It was not that long ago that we were experiencing bidding wars where homes escalated in the double digits. As you can see, the higher price results in a higher payment even with the lower rate.

the effect that price appreciation will have despite rates being lower. It was not that long ago that we were experiencing bidding wars where homes escalated in the double digits. As you can see, the higher price results in a higher payment even with the lower rate.

caused prices to bottom out in Snohomish County in February 2023 at $685,000, and in King County in January 2023 at $800,000. The bulk of the correction took place in 2022, and 2023 was the year of resetting price stability and the return of appreciation. What was fascinating about this growth is that interest rates still averaged around 7% throughout 2023.

caused prices to bottom out in Snohomish County in February 2023 at $685,000, and in King County in January 2023 at $800,000. The bulk of the correction took place in 2022, and 2023 was the year of resetting price stability and the return of appreciation. What was fascinating about this growth is that interest rates still averaged around 7% throughout 2023.