Holy Shift, Again!

Most of the Market Correction Behind Us & Growth Ahead!

Markets change fast! We experienced a substantial shift in 2022 with the first half of the year feeling like a completely different market than the second half of the year. A 3-point increase in interest rate was the main culprit along with inflation and affordability for the 2022 market correction we experienced.

A market correction is defined by prices reverting by 10% or more. In January 2022 the median price in Snohomish County started at $700,000 then peaked at $830,000 in April, and ended the year at $689,000 (-17%). In King County, the median price started at $794,000 then peaked at $1,000,000 in May, and ended the year at $820,000 (-18%). Bear in mind that the December 2022 median price was also up 17% over the January 2021 median price in Snohomish County and up 12% in King County. This illustrates that the correction was only off the peak of spring 2022 not off of the strong equity that was built prior to that intense run-up.

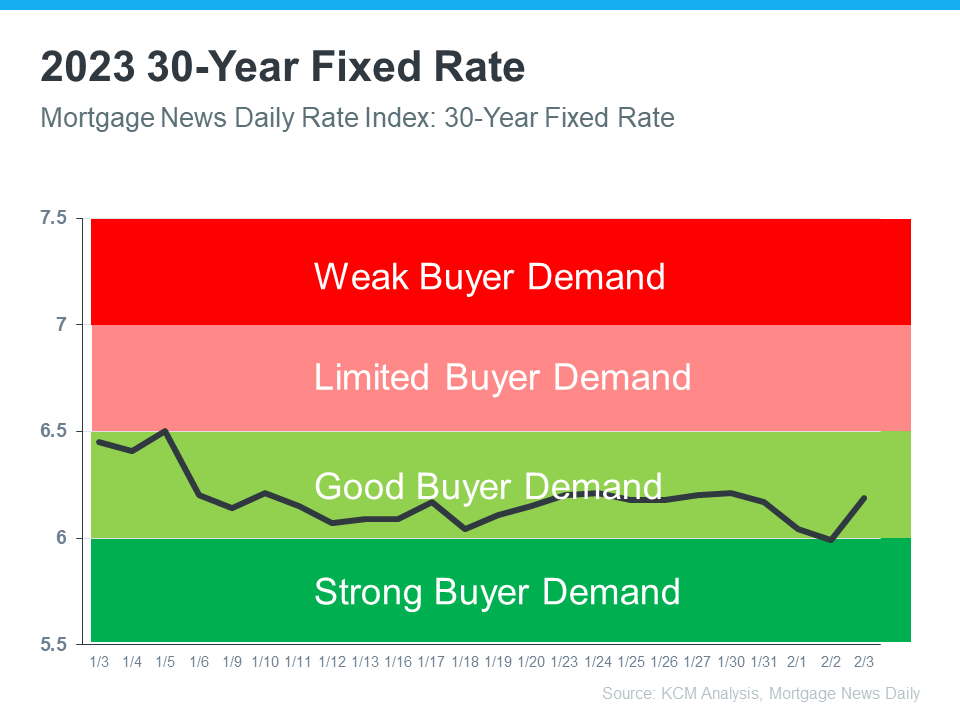

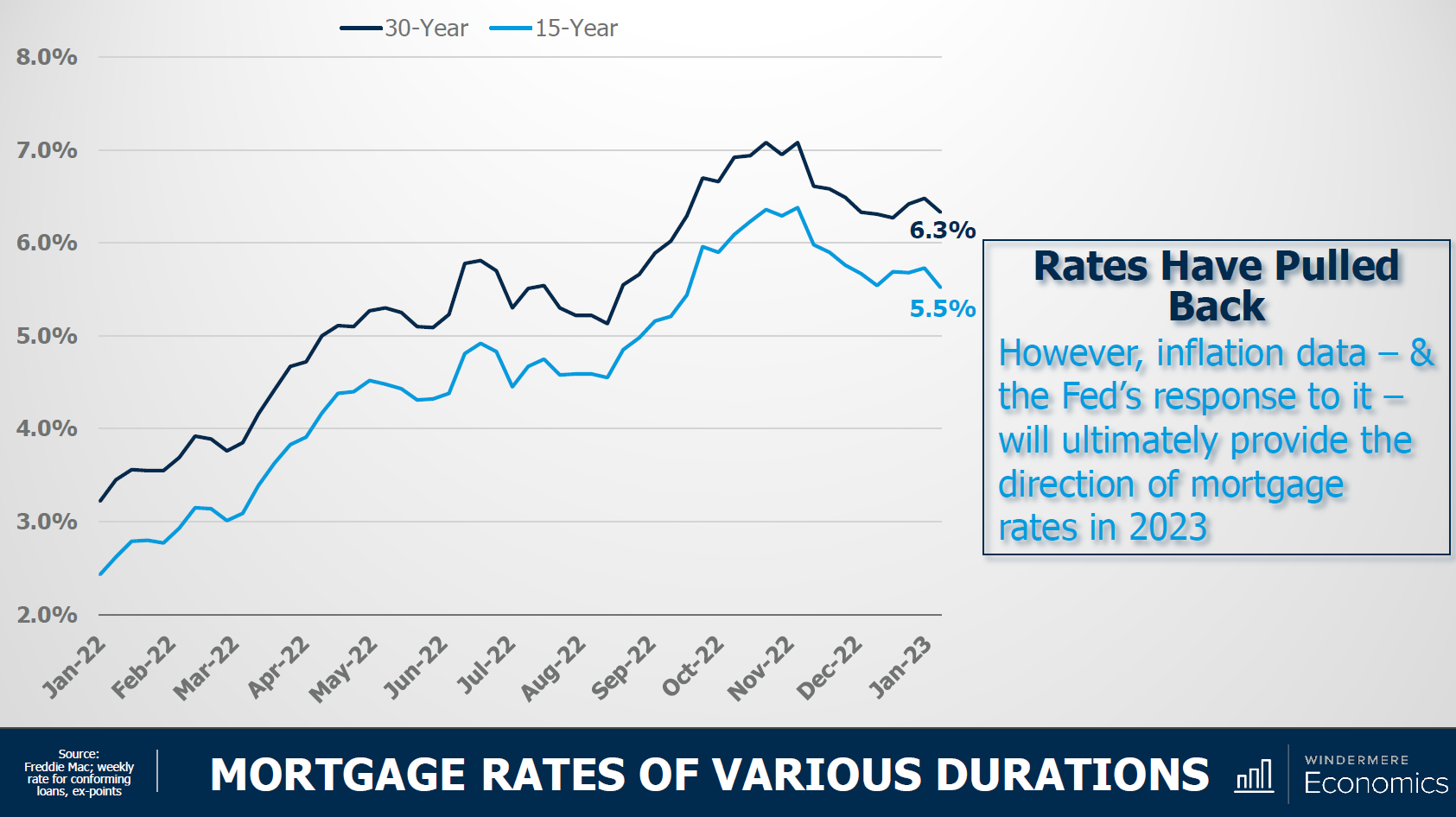

As we find ourselves in mid-Q1 2023 all data points and anecdotal stories are pointing to the worst of the market correction being behind us and yet again, another shift. Interest rates peaked in November 2022 at just over 7% and have since come down. Experts are predicting rates to find themselves under 6% as we travel through the easing of inflation in 2023.

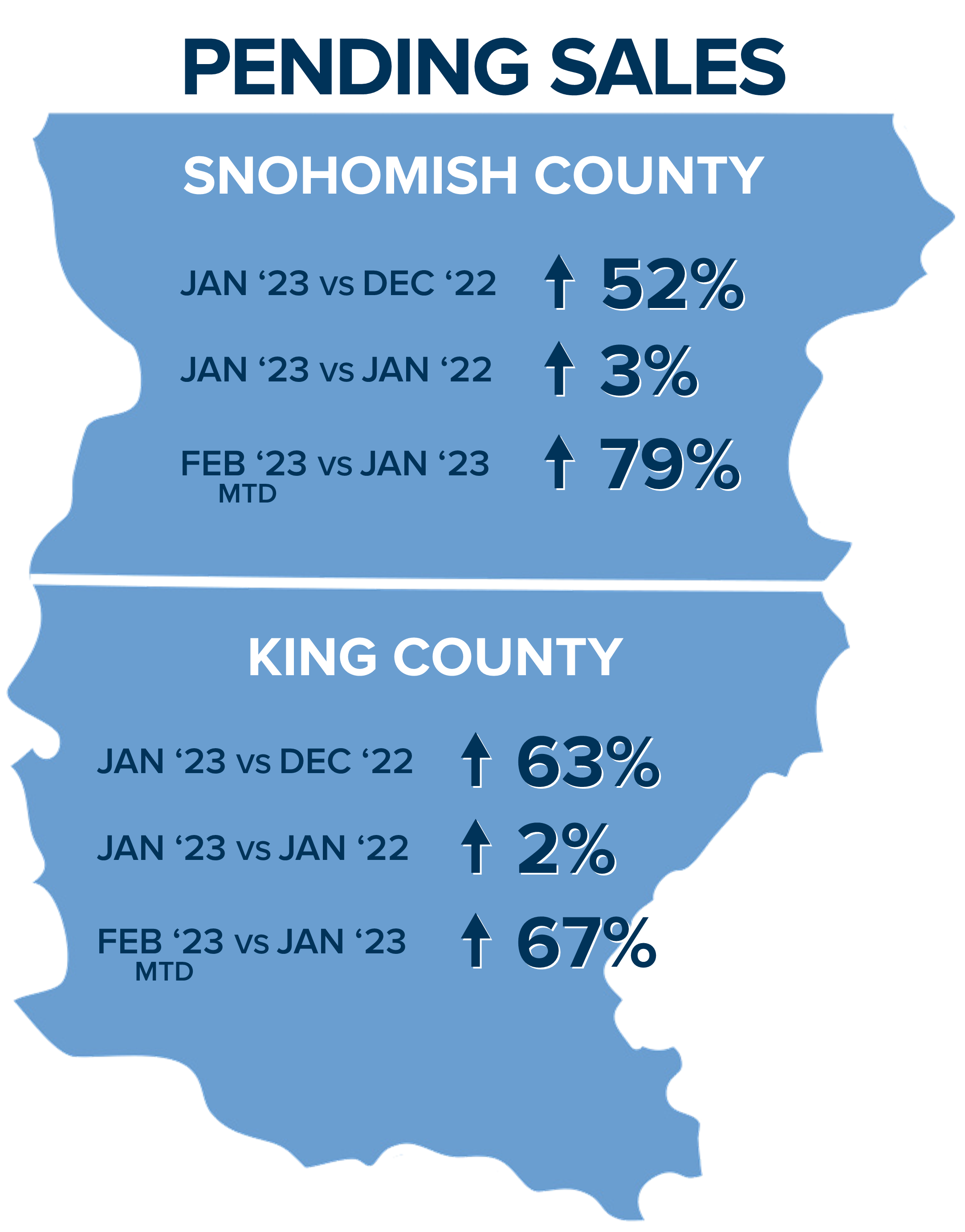

The well-defined price correction and interest rates lowering have brought many buyers back to the market. In fact, pending sales in Snohomish County in January 2023 were up 52% over December 2022 and were up 3% over January 2022. Even more so an indicator: pending sales are up 80% month-to-date (MTD) in February over January 2023! In King County, pending sales in January 2023 were up 63% over December 2022 and were up 2% over January 2022, and up 61% MTD over January 2023.

This pent-up demand has come at a time when listing inventory is seasonally scarce and has tilted the market from a balanced market back to a seller's market in many areas. Months of inventory is how we define market conditions. 0-2 months is a seller's market, 2-4 months a balanced market, and 4 months plus a buyer's market. In Snohomish County, we ended 2022 with 2.3 months of inventory based on pending sales, and in January 2023 had 1.2 months, and MTD is sitting at 0.9 months. In King County, we ended 2022 with 2.6 months of inventory based on pending sales, and in January 2023 had 1.3 months, and MTD is sitting at 1.1 months.

After months of price reductions and searching for the bottom, we are now starting to come across some multiple offers and price increases. This is leaving clues that the bottom was reached and that we are now stabilizing and looking toward the predicted growth that 2023 has to offer. Buyers are eager for additional selection and will welcome the spring influx of new listings. If sellers are ready, they should not hesitate. Should rates lower as the new listings arrive, sellers will be well supported by a willing buyer audience ready to absorb any growth in inventory.

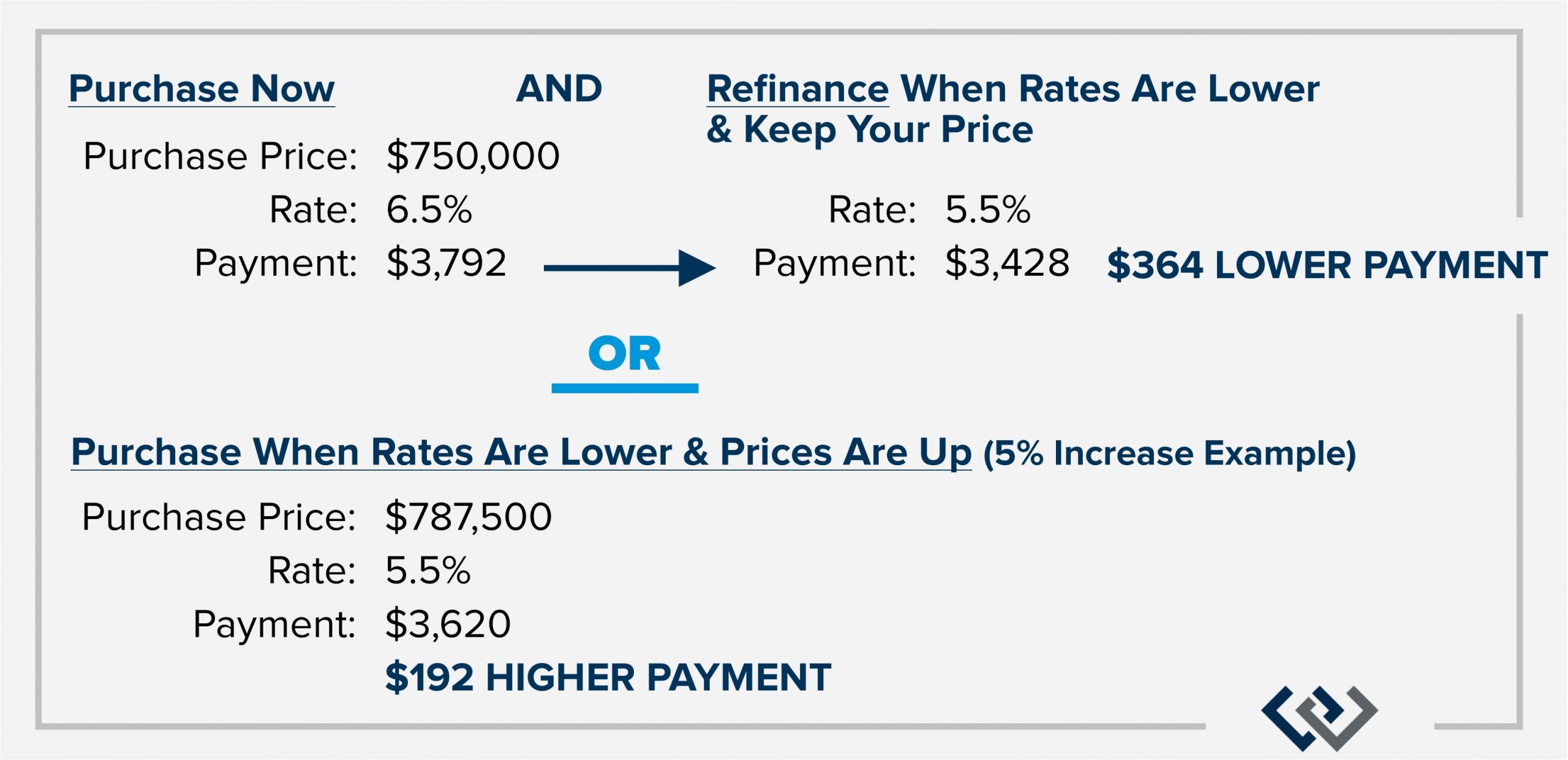

Buyers need to understand that rates and prices are closely related and that waiting for rates to hit a certain point may be detrimental to securing a stabilized price. Many buyers are heading into today's market with a refinance in mind down the road. They are aware that prices will rise as rates lower, so they are looking to obtain a lower price now with a higher rate and once the rate hits their desired level, they will refinance to lower their payment all while holding on to their lower basis point.

For example, if a buyer bought now at $750,000 with 20% down and a rate of 6.5% their monthly principal and interest payment would be $3,792. If a year from now, rates are at 5.5% and prices are up 5% and that same buyer refinances, they will save $364 a month on their payment and $37,500 in principle. This would also be $192 lower than what the payment would be at the appreciated price with the lower rate!

Real estate moves are driven by life changes. It was completely understandable that many buyers took a pause as the market corrected. Now that the market is showing signs of stabilizing these life changes are pushing buyers to find the home that better fits their lifestyle. Sellers need to keep in mind that their homes need to be priced right and show up to the market well-appointed and properly prepared to get the best results.

We've learned a lot over the last year. Once the historical 3-4% interest rate disappeared, consumers had to adapt to the new normal. Now that consumer sentiment is leaning towards a resurgence in demand, opportunity abounds for sellers who are ready to make a move. Please reach out if you are curious about the market trends and want to discuss your goals. It is always my goal to help keep my clients well-informed and empower strong decisions. 2023 is going to be a great year for real estate, I can feel it!

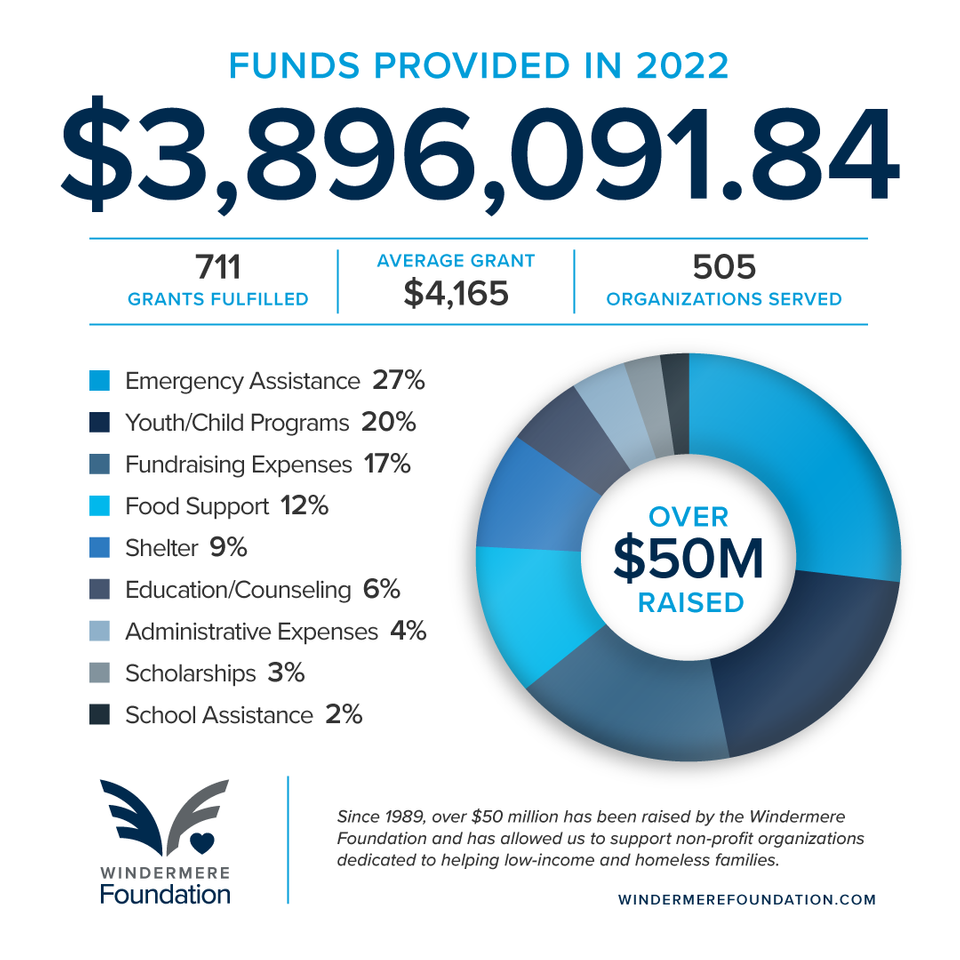

At Windermere we help people buy and sell homes, but we also help build community. I’m proud to support the Windermere Foundation which has raised over $50 million in the past 34 years for low-income and homeless families right here in our local community.

2023 REAL ESTATE FORECAST: WHY THIS MARKET WON'T BE LIKE 2008

By Matthew Gardner

Hello there, I’m Windermere’s Real Estate’s Chief Economist Matthew Gardner and welcome to the first episode of “Monday with Matthew” for 2023. As has become tradition, this first episode of the year will be dedicated to my real estate forecast for the U.S. housing market, so let’s get straight to it.

2023 Real Estate Forecast

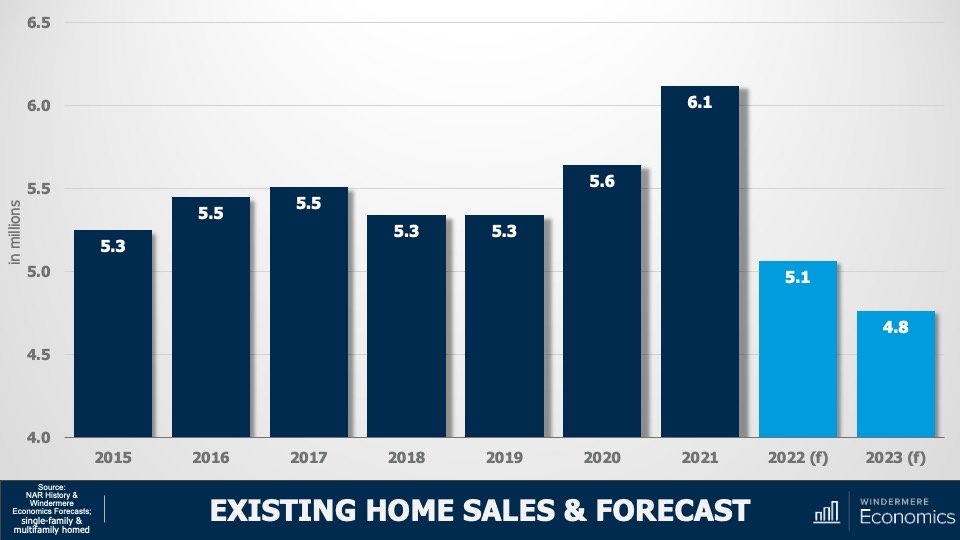

Existing Home Sales & Forecast

Image Source: Matthew Gardner

U.S. home sales trended lower through all of 2022 and, although I believe that sales will still have held above five million, this certainly won’t be the case in 2023. Affordability and higher financing costs will continue to act as headwinds when it comes to sales, but I think that the bigger issue will be that listing activity will not rise significantly as we move through the year.

As I have been saying for several months now, I don’t see why many households who don’t have to move will move and lose the historically low interest rate that they currently benefit from. That said, sales will still occur this year but at just 4.8 million, sales will be lower than we have seen since 2014.

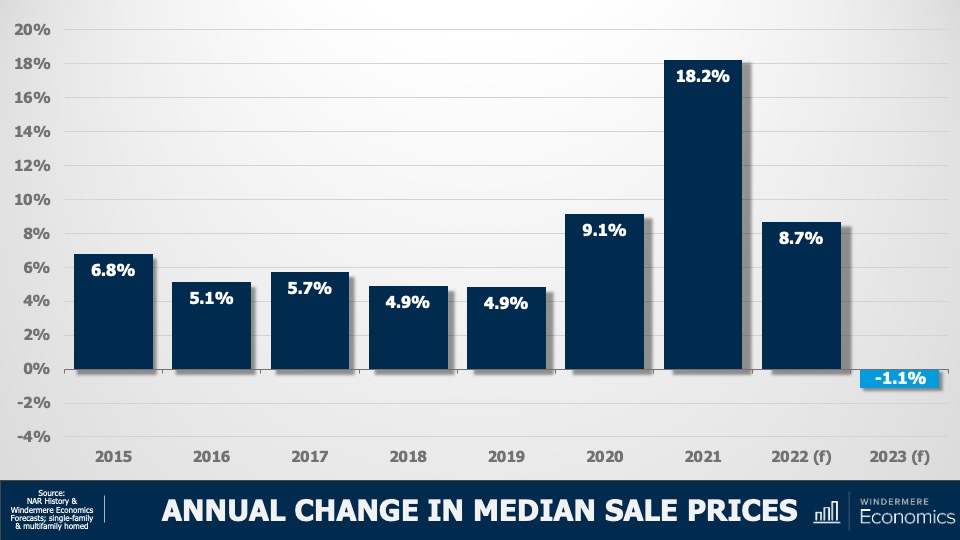

Annual Change in Median Sale Prices

Image Source: Matthew Gardner

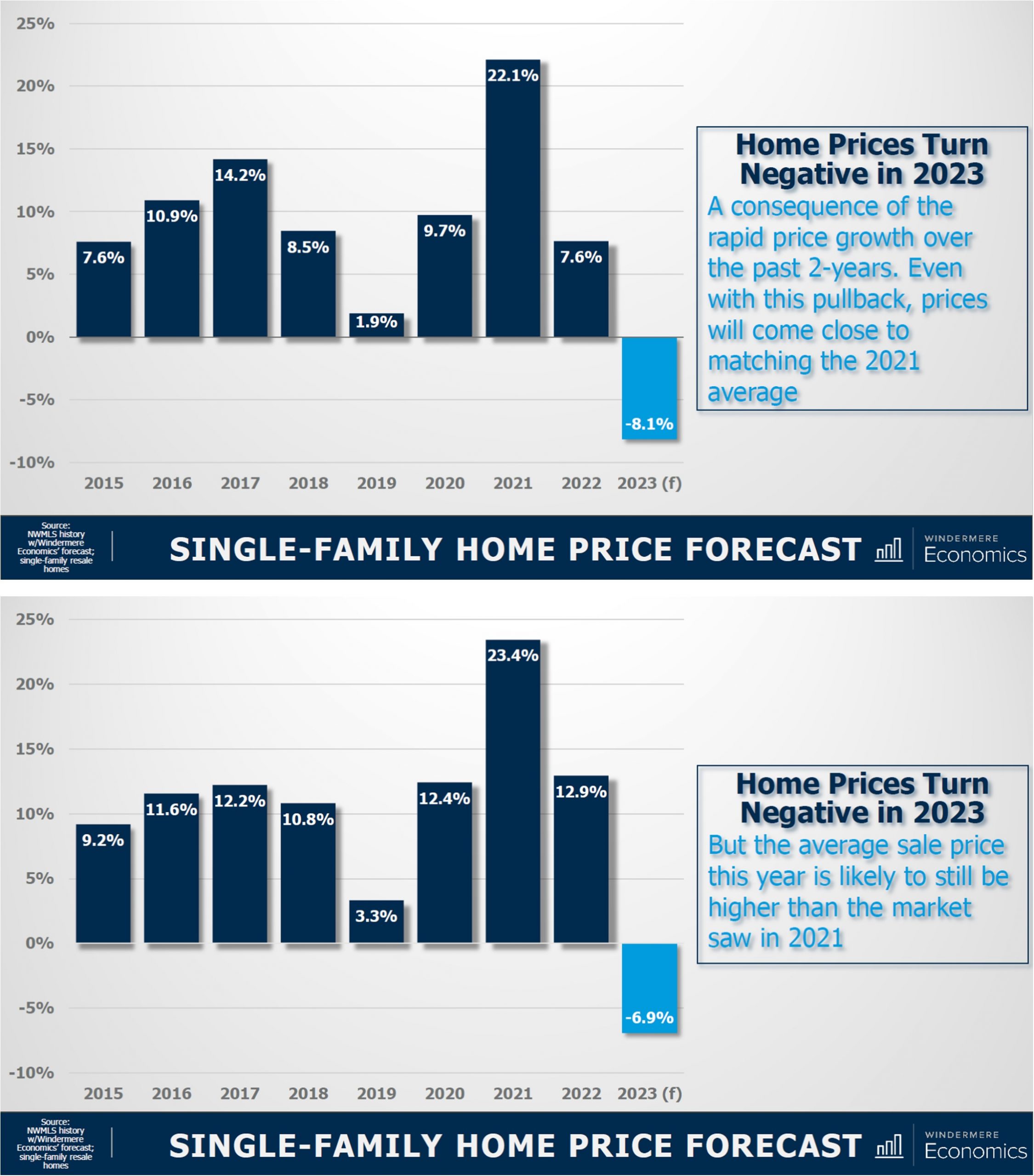

Much has been said about the future of home prices, with some forecasters even suggesting that housing prices will collapse in a similar fashion to that seen following the bursting of the housing bubble back in 2008. Now, although price growth through the pandemic period was clearly excessive, fundamentally speaking, the two periods cannot be considered to be similar at all.

It’s my opinion that sale prices in 2023 will be very modestly lower than last year and I certainly don’t expect to see a collapse in home values.

But not all markets are created equal. The pandemic created what has become known as “Zoom-Towns.” These were cheap markets that affluent buyers flocked to because of their newly found ability to work from home and this led sale prices there to soar. It’s these locations that will likely see prices fall more significantly. Ultimately, expect to see prices fall through the first half of this year before starting to recover in the second half.

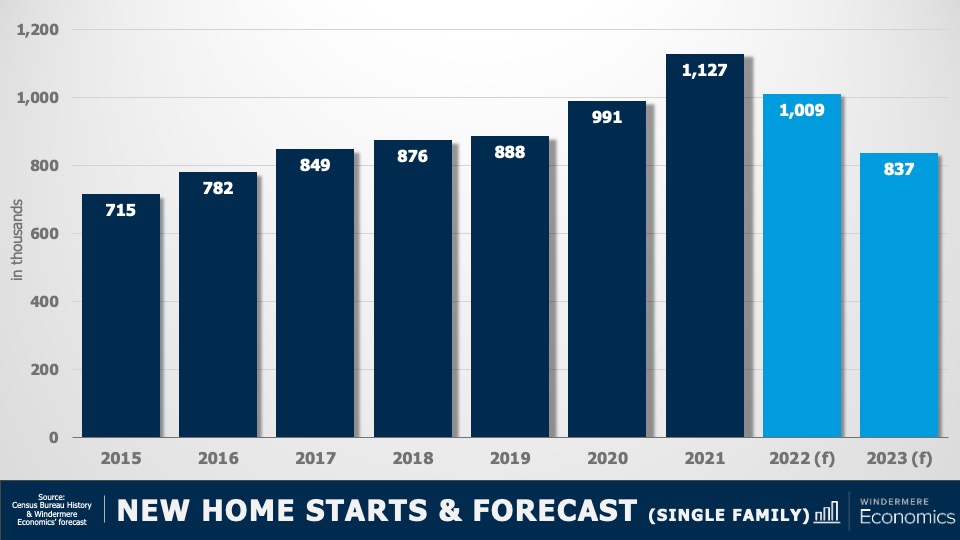

New Home Starts & Forecast (Single Family)

Image Source: Matthew Gardner

Looking now at the new construction market, housing starts fell last year as construction costs remained high and mortgage rates rose which lowered demand. And I’m afraid that I do not see 2023 as being one where builders will deliver more inventory, with starts pulling back to a level the country hasn’t seen since 2016. That said, I am expecting a recovery in 2024 when new home starts will break back above the 1,000,000 level.

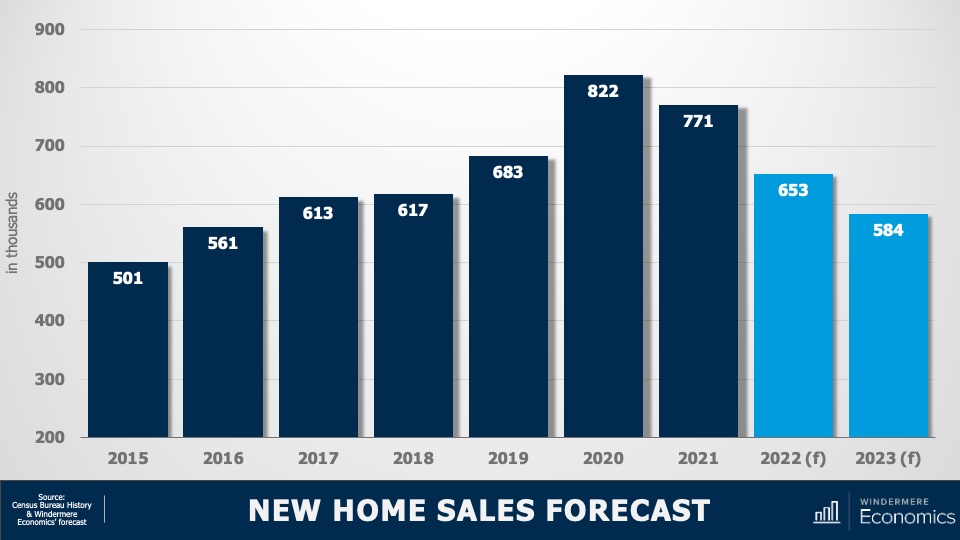

New Home Sales Forecast

Image Source: Matthew Gardner

New home sales in 2023 will fall further coming in below 600,000 but there is some light at the end of the tunnel with sales picking up fairly significantly again in 2024. We all understand that the country has a significant undersupply of ownership housing, but the costs associated with building new homes is still making it remarkably hard for builders even though they understand that demand will be significant for at least the next decade and a half given current demographics.

But the problem they will continue to face is that demand will primarily come from entry level buyers and, simply put, the cost to build a home precludes many developers from being able to meet this demand.

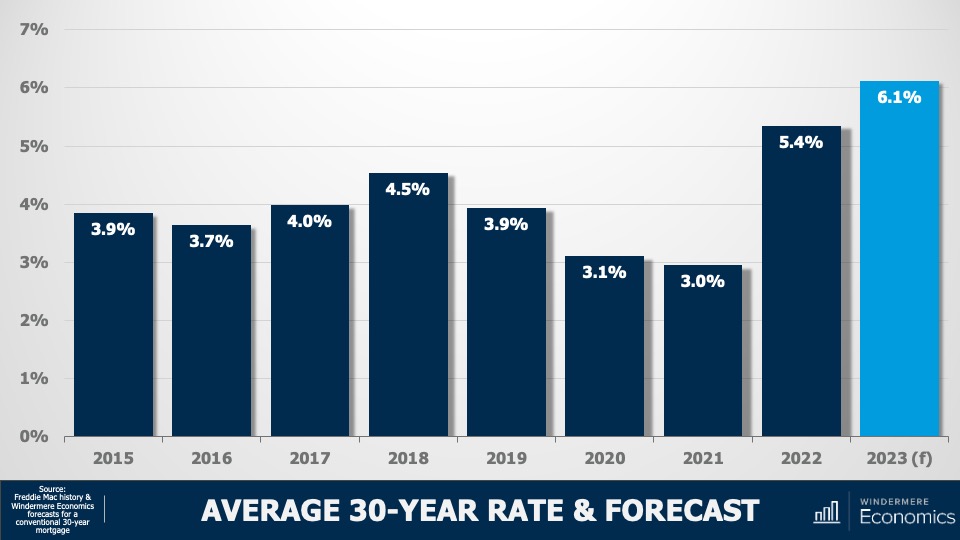

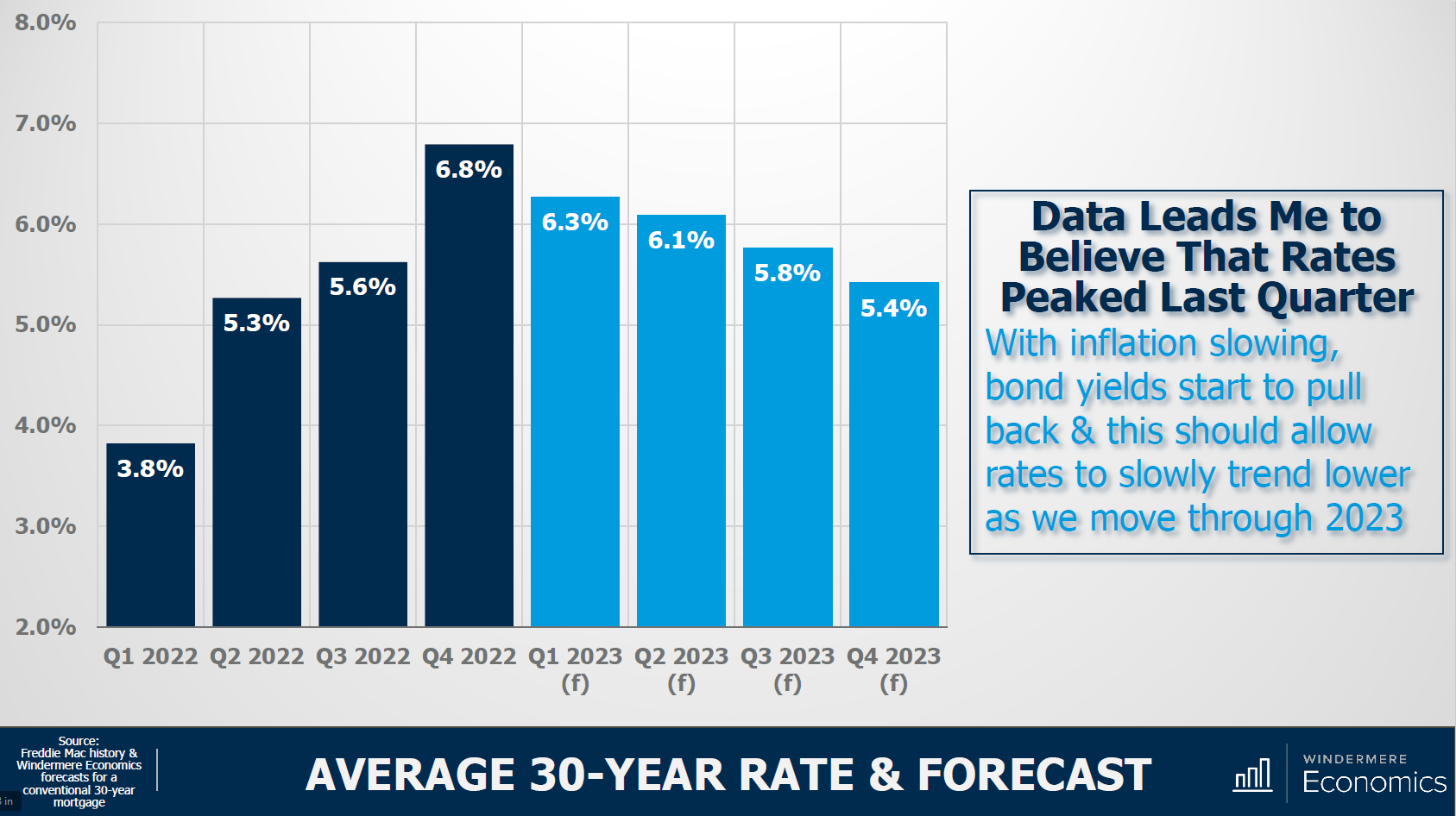

Average 30-Year Mortgage Rate & Forecast

Image Source: Matthew Gardner

And finally, my forecast for mortgage rates in 2023. Although this might not look good at all, as they say, “the devil is in the details.” Rates skyrocketed last year as the Fed stopped buying treasuries and mortgage-backed securities and, although they are off the highs we saw toward the end of last year, they are still significantly higher today than the market has become used to seeing.

As you can see here, I’m anticipating the average 30-year conventional rate to average 6.1% in 2023, but my forecast is actually a bit better than this shows.

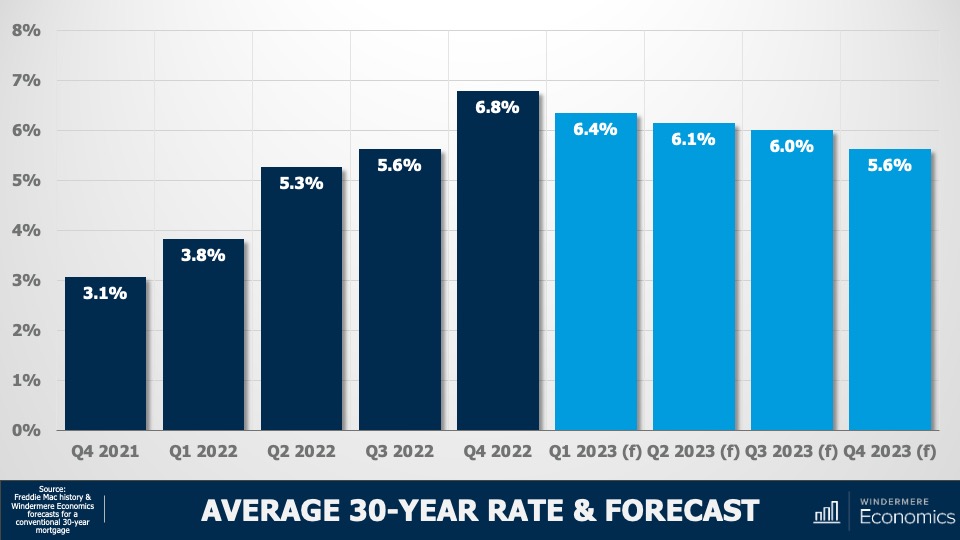

Average 30-Year Mortgage Rate Forecast 2023

Image Source: Matthew Gardner

You see, my quarterly forecast suggests that rates have actually already peaked, and that they will trend lower as we move through this year and break below 6% by the fourth quarter. I would add that if anything my forecast may be a little pessimistic, and rates may end 2023 a little lower than I am showing here.

But that will depend on the Fed, and how long they will continue raising rates, and how long it will take before they start to lower them if the US enters a recession this year, which many forecasters including myself believe will be the case.

So, there you have it, my 2023 U.S. housing forecast. I will leave you with this one last thought. 2023 will be a transition year when the housing market will come off the “high” we saw during the pandemic and borrowing costs were artificially low.

I don’t see any reason for buyers or sellers to panic though. By the end of 2023, most markets will have corrected themselves and I believe we will see prices and demand start to pick up again toward the end of this year, but at a far more normalized pace.

As always, I look forward to your comments on my forecasts and I’ll see you all again next month. Take care now.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

An Economic & Housing Forecast for 2023 by Economist Matthew Gardner

Last week, my office had the pleasure of hosting Windermere's Chief Economist, Matthew Gardner for his 2023 Economic and Housing Forecast. During this jam-packed hour of insightful delivery, he reported on the U.S. and local economies along with the U.S. and local housing markets specific to King and Snohomish Counties. If you are interested in receiving the recording of the event and/or his PowerPoint slides, please reach out. You can also access the link at the bottom of this newsletter to get his concise forecast for the U.S. housing market.

Across the nation, we saw a real estate market correction in 2022 as interest rates doubled. Interest rates started the year at just over 3%, peaked in November at just over 7%, and ended at just under 6.5%. Since the first of the year, we are closer to 6% and anticipate rates to continue to improve towards 5% throughout 2023. The Feds utilized rising interest rates to combat inflation in an effort to create a short recession to slow the cost of all products and services after record-breaking increases during the pandemic. This has reduced spending due to money becoming more expensive to borrow and corrected prices across many industries, including housing.

The trends across the nation are consistent, but as your local expert, along with the national forecast I am committed to reporting hyper-local facts, figures, and trends to help you understand what is happening and what will happen right in our own backyard. Our local housing market was not immune to the effects of rising interest rates. Our prices peaked in the spring and as rates climbed over 6%, prices took a tumble from the spring highs inflated by cheap money. However, prices are still higher than they were in 2021 which was a recording-breaking year of price growth.

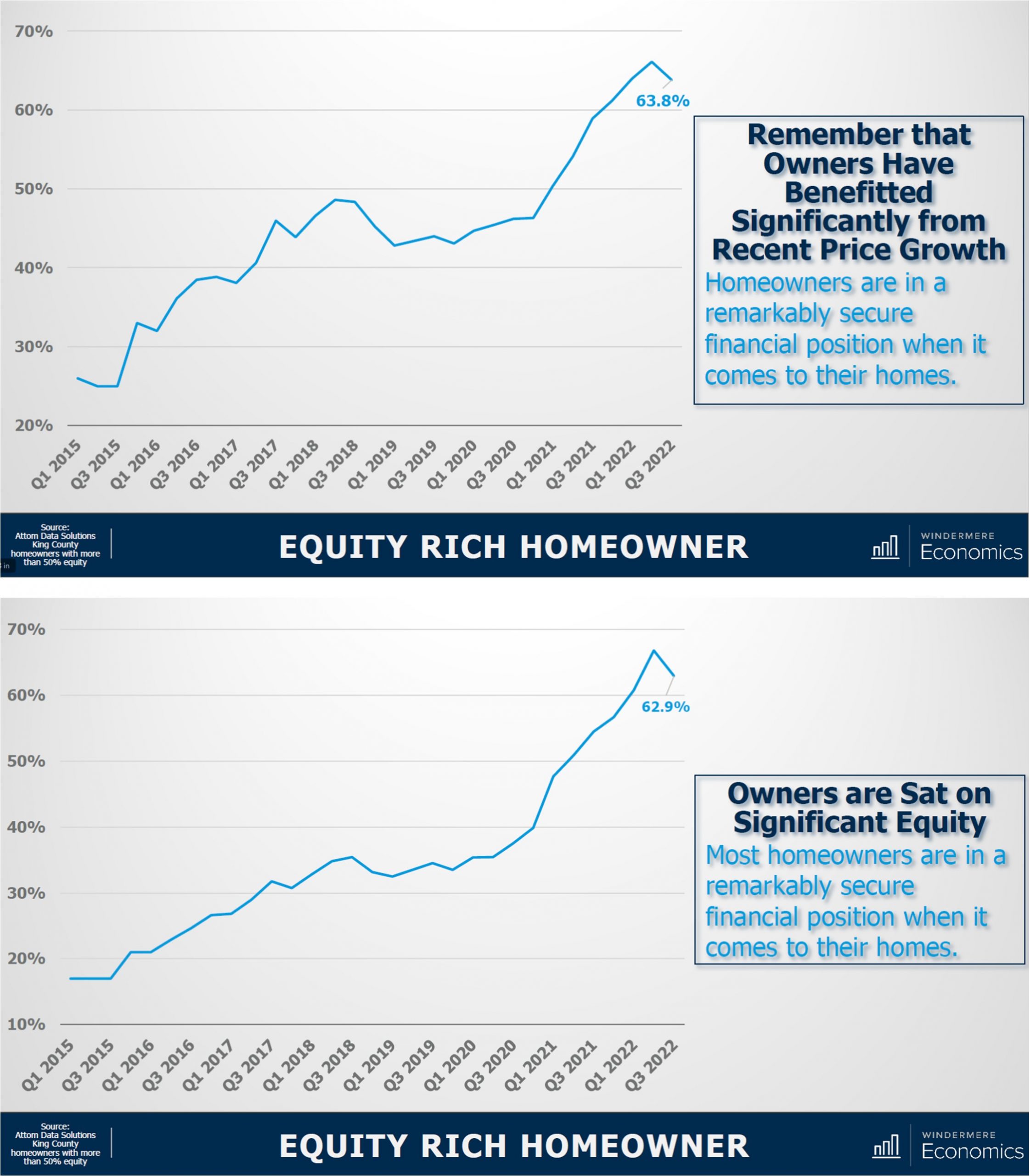

In King County, prices were up 22% in 2021, and in Snohomish County, they were up 23%. We started 2023 with higher prices over 2021, but off the peak of 2022. This is a price reversion, not a housing recession! In fact, in King County, 64% of homeowners with a mortgage have over 50% home equity and in Snohomish County, 63% of homeowners with a mortgage have over 50% home equity. Homeowners are fortified with strong cash positions which is a clear indicator we are nowhere near a housing crisis; we are actually incredibly healthy! While the highs of 2022 were wiped out, the long-term growth we have had over the last decade is the foundation and guiding light of our market. If you bought in 2022, don't fret, just hold, values will eventually return.

The worst of this correction seems to be behind us as rates are expected to continue to improve throughout 2023 and consumers are adjusting to a more normalized market. Prices are starting to stabilize and are near, if not at the bottom, and should have modest growth in the second half of 2023. We are already starting to see pending sales pick up. Month-to-date (MTD), pending sales are up 25% in King County over December (month-over-month, MOM) and up 21% MOM in Snohomish County. This increase in pending sales is coupled with available inventory being down 15% MOM in King County and down 18% MOM in Snohomish County. Inventory remains tight with MTD inventory levels shifting from a balanced market to a moderate seller's market based on pending sales rates in both counties.

It seems that buyer demand is improving and activity is becoming more plentiful. Buyers should take note and be ready to transact if they are poised to make a move. It is a delicate dance between prices and interest rates. Buyers must understand that they can't change their sale price once they've bought, but they can always refinance and change their rate. I have even heard of lenders guaranteeing a future refinance when the rate hits a certain point. Real estate is a long-term hold investment and also where you live. If where you are at doesn't currently meet your needs, consider a move if you plan to stay there for 5+ years.

Affordability has been a challenge in our area, so if a buyer can obtain a good price this year and then adjust their rate later by refinancing, they will have a much more affordable monthly payment down the road. This takes strategizing and planning and the guidance of a trusted lender and real estate broker. Utilizing adjustable-rate mortgages, rate buydowns, and other creative financing options has put savvy buyers in the catbird seat as they navigate this environment and make exciting moves.

Matthew's closing words summarized the wild ride of coming off of the pandemic and where we are headed. "2023 will be a transition year when the housing market comes off the high that we saw during the pandemic when borrowing costs were artificially low. I don’t see any reason for buyers or sellers to panic at all! By the end of this year, most markets will have already corrected themselves and we will see prices and demand pick up again, but at a far more normalized pace.”

Real estate is an investment and a lifestyle decision. I am committed to following experts like Matthew and others. I also study the local market trends daily. Markets change quickly and the changes are often reported far after the actual shift. I have understood these shifts due to my daily connection to the market. I take great pride in helping empower my clients to make well-informed decisions about where they live and the financial impact it has on their lives. I love what I do because it is centered in helping people with one of the biggest decisions they will make in their life. If you or someone you know are curious about how the trends relate to your goals, please reach out. I'd be honored to help educate you and help guide and strategize your next move. Here's to a happy and healthy 2023!

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HOW

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In Snohomish County, from April 2020 to the peak (April 2022) prices grew by 60%, and in King County, from April 2020 to the peak (May 2022) prices grew by 39%. Bear in mind that historical norms for annual price appreciation are 3-5%, making this two-year time period unlike any other! The Fed needed to make the cost of borrowing money more expensive in order to slow down inflation. This was applicable to the entire economy not just real estate, causing short-term rates to increase for credit cards, car loans, and lines of credit, as well as long-term mortgage rates.

In Snohomish County, from April 2020 to the peak (April 2022) prices grew by 60%, and in King County, from April 2020 to the peak (May 2022) prices grew by 39%. Bear in mind that historical norms for annual price appreciation are 3-5%, making this two-year time period unlike any other! The Fed needed to make the cost of borrowing money more expensive in order to slow down inflation. This was applicable to the entire economy not just real estate, causing short-term rates to increase for credit cards, car loans, and lines of credit, as well as long-term mortgage rates.

With that said, sellers have amazing gains to enjoy, and not overshooting their price will lead to the most profitable and drama-free outcome. In King County in August, 37% of homes sold at or above the list price, and 34% in Snohomish County; that is 1 in 3 homes! These homes were brought to market with accurate pricing that attracted a buyer pool that understood the value and was motivated to offer. Market time was also shorter. Homes in King and Snohomish Counties that sold in 15 days or less averaged a list-to-sale price ratio of 100% and homes that sold in 15-30 days took close to a 5% hit on list price. When the days on market get longer the hit on list price gets even higher. It is important to get the pricing right in the beginning. Thorough research, properly focused perspective, and clear communication all play into this success.

With that said, sellers have amazing gains to enjoy, and not overshooting their price will lead to the most profitable and drama-free outcome. In King County in August, 37% of homes sold at or above the list price, and 34% in Snohomish County; that is 1 in 3 homes! These homes were brought to market with accurate pricing that attracted a buyer pool that understood the value and was motivated to offer. Market time was also shorter. Homes in King and Snohomish Counties that sold in 15 days or less averaged a list-to-sale price ratio of 100% and homes that sold in 15-30 days took close to a 5% hit on list price. When the days on market get longer the hit on list price gets even higher. It is important to get the pricing right in the beginning. Thorough research, properly focused perspective, and clear communication all play into this success.

For the buyers who bought during these peak times, it is understandable that there is some angst over the shift in the market. They can find comfort in the low rate they secured, which created a lower payment and offsets the money they put towards debt service. They also need to understand that real estate has always been a long-term hold investment and that future price appreciation is anticipated, but at more historical norms.

For the buyers who bought during these peak times, it is understandable that there is some angst over the shift in the market. They can find comfort in the low rate they secured, which created a lower payment and offsets the money they put towards debt service. They also need to understand that real estate has always been a long-term hold investment and that future price appreciation is anticipated, but at more historical norms.

In Snohomish County, days on market for homes that sold in June for over list price was 5 days, which accounted for 49% of the sales with an average escalation of 5%. This illustrates that there are still great homes that buyers are flocking to, but it is imperative that they are properly positioned in the market. This takes skill, research, and a reasonable approach to find this success as a seller. Conversely, 34% of sales in June sold under list price or took a price reduction and averaged 12 days on market and 27 days on market respectively. This mash-up requires sophisticated navigation and reasonable cooperation, but ultimately sellers will find success because they are sitting on a mound of historical equity growth.

In Snohomish County, days on market for homes that sold in June for over list price was 5 days, which accounted for 49% of the sales with an average escalation of 5%. This illustrates that there are still great homes that buyers are flocking to, but it is imperative that they are properly positioned in the market. This takes skill, research, and a reasonable approach to find this success as a seller. Conversely, 34% of sales in June sold under list price or took a price reduction and averaged 12 days on market and 27 days on market respectively. This mash-up requires sophisticated navigation and reasonable cooperation, but ultimately sellers will find success because they are sitting on a mound of historical equity growth. In King County, days on market for homes that sold in June for over list price was 5 days, which accounts for 50% of the sales with an average escalation of 6%. Conversely, 30% of sales in June sold under list price or took a price reduction and averaged 13 days on market and 27 days on market respectively.

In King County, days on market for homes that sold in June for over list price was 5 days, which accounts for 50% of the sales with an average escalation of 6%. Conversely, 30% of sales in June sold under list price or took a price reduction and averaged 13 days on market and 27 days on market respectively.

We are holding a Food Drive through the month of July, with a goal to donate $5,000 to the Volunteers of America Food Banks across Snohomish County. You can

We are holding a Food Drive through the month of July, with a goal to donate $5,000 to the Volunteers of America Food Banks across Snohomish County. You can